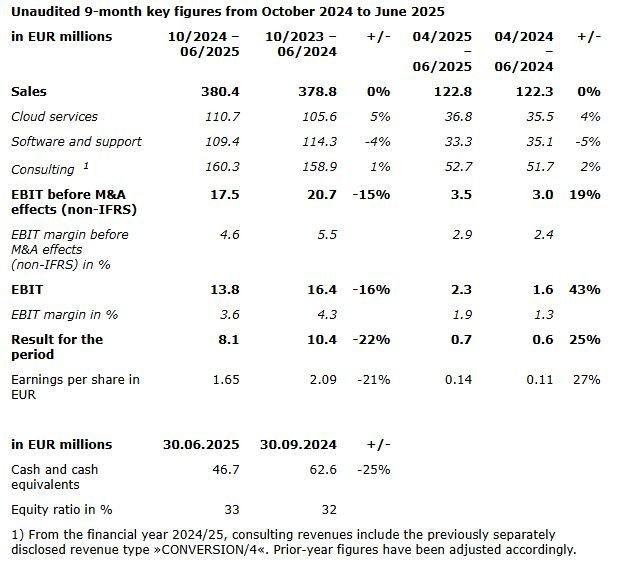

- 3rd quarter: Revenue just above prior year at EUR 122.8 million (Apr – Jun 2024: EUR 122.3 million) // EBIT before M&A effects (non-IFRS) increases by 19% to EUR 3.5 million

- 9-month period: Revenue rises slightly from EUR 378.8 million to EUR 380.4 million // Solid growth in cloud services up 5% // EBIT before M&A effects (non-IFRS) declines by 15% to EUR 17.5 million // EBIT margin before M&A effects (non-IFRS) at 4.6% (Oct 2023 – Jun 2024: 5.5%)

- Increased geopolitical uncertainty leads to unexpected delays in project launches and fewer new contracts for ERP migrations

- Major challenges in LOB segment due to decline in Customer Experience

- Share of recurring revenues at 52% (Oct 2023– Jun 2024: 52%) 1

- Well-equipped for successful internationalisation and growth with a new operating model // Expansion of global delivery model and product business increases scalability

- Revised forecast for 2024/25 financial year confirmed

1) Prior-year figure adjusted due to reallocation of revenue types

Filderstadt, 7 August 2025 – Today, All for One Group SE, a leading international IT, consulting and service provider focusing on SAP solutions and services, published its unaudited figures for the period from 1 October 2024 to 30 June 2025. In the 2024/25 financial year to date, the company has been unable to escape the negative effects of a weak economy, impending tariffs and companies‘ reluctance to invest.

Sales rose slightly in Q3 2024/25, from EUR 122.3 million to EUR 122.8 million, while EBIT before M&A effects (non-IFRS) increased significantly by 19% to EUR 3.5 million (Apr – Jun 2024: EUR 3.0 million).

Based on unaudited figures, All for One achieved a slight increase in revenue in the nine-month period from 1 October 2024 to 30 June 2025, reaching EUR 380.4 million (Oct 2023 – Jun 2024: EUR 378.8 million). Compared to the previous year, there has been a shift from the resell model of on-premise solutions to commission-based cloud solutions with different revenue recognition dates. Influenced by subdued demand, EBIT before M&A effects (non-IFRS) amounted to EUR 17.5 million in the 9-month period (Oct 2023 – Jun 2024: EUR 20.7 million). This corresponds to an EBIT margin before M&A effects of 4.6% (5.5% in the prior-year period). Recurring revenues increased by 1% to EUR 199.2 million and account for 52% (Oct 2023 – Jun 2024: 52%) of total revenue (prior-year figure adjusted due to reallocations of revenue types). Cloud services revenue continued its robust upward trend, rising by 5% to EUR 110.7 million.

Market for digitalisation and transformation is growing – Postponements and reluctance in implementing IT projects

The uncertain macroeconomic environment is causing many customers to postpone or spread out investments in their IT infrastructure. Even though the need for digitalisation and transformation, as well as the introduction of integrated SAP cloud solutions for corporate management, is obvious, uncertainty about business development, tariff increases and their own order situation is forcing companies to adjust their investment budgets.

In the CORE segment, potential orders are frequently postponed at short notice, and fewer new contracts are being signed for ERP migration projects. This reluctance means that the decline in licence and maintenance revenues from expiring on-premise contracts as a result of cloud-based solutions is being offset more slowly. For the CORE segment, this resulted in revenue of EUR 339.0 million for the period from October 2024 to June 2025 (Oct 2023 – Jun 2024: EUR 334.8 million) and EBIT before M&A effects (non-IFRS) of EUR 16.2 million (Oct 2023 – Jun 2024: EUR 16.4 million). This includes one-off effects from severance payments and exemptions amounting to EUR 2.2 million as a result of the new corporate organisation introduced in October 2024. The segment’s EBIT margin before M&A effects (non-IFRS) for the nine-month period was 4.8% (Oct 2023 – Jun 2024: 4.9%).

In the LOB segment, performance remains unsatisfactory. Customers are postponing investments in specific lines of business solutions. Changes in SAP’s solution portfolio, particularly in the area of customer experience, are creating additional headwinds. Nevertheless, All for One remains committed to offering LOB solutions and services to complement its portfolio and support its »Land and Expand« strategy. Segment sales for the 9-month period were EUR 54.7 million (Oct 2023 – Jun 2024: EUR 56.2 million) and EBIT before M&A effects (non-IFRS) was EUR 1.2 million (Oct 2023 – Jun 2024: EUR 4.3 million) with a margin of 2.3% (Oct 2023 – Jun 2024: 7.6%).

»We cannot detach ourselves from the difficult economic situation. Our pipeline indicates significant interest from midmarket businesses in cloud-based ERP solutions, particularly »RISE with SAP« and »GROW with SAP«, as well as in All for One as their preferred migration project partner. However, given the lack of visibility regarding economic development, necessary investments are also being postponed or spread out over time«, says Michael Zitz, CEO of All for One, describing the challenging environment. »Based on our comprehensive pipeline, we expect to benefit directly from an economic upturn and move projects straight into implementation. Contrary to expectations, this has not yet happened and customers remain cautious and reluctant to make long-term investment decisions.«

Strategic focus confirmed – new operating model supports internationalisation and growth

Despite the current weakness in demand, All for One expects a return to growth. The course has been set: the business model is being restructured and developed further to become a globally active service and consulting company with a strong SAP focus for medium-sized and upper midmarket companies within All for One’s core industries. Strategically, the company considers itself to be very well-positioned with its »Land and Expand« strategy (initially providing customers with SAP ERP solutions, followed by the expansion of lines of business solutions) and its new operating model that has been implemented. At its core is the scalable matrix organisation, which provides customers with complete end-to-end solutions from a single source within the country organisation. The product business under the blue-zone brand will be expanded further, enabling All for One to benefit from higher margins and long-term, predictable revenues. This integrated and comprehensive offering enables All for One to provide more comprehensive support to customers in end-to-end process consulting and the global implementation and further development of IT solutions.

Further internationalisation is part of the growth strategy. The integration of the company’s Regional Delivery Centers into the value chain will be increased, and new international locations will be established to strengthen All for One’s position as a global partner for SAP-related services and consulting. Targeted acquisitions will be used to access further attractive markets, expand the range of services and increase industry focus.

»Acquisitions are part of our growth strategy. They must contribute to our business model and enable us to leverage our scaling opportunities, thereby strengthening our profitability further«, says Stefan Land, CFO of All for One.

As of 30 June 2025, the balance sheet total amounted to EUR 322.9 million (30 Sep 2024: EUR 343.1 million), with an equity ratio of 33% (30 Sep 2024: 32%). The number of employees in the Group as of 30 June 2025 was 2,674 (30 Jun 2024: 2,793).

Adjusted forecast for 2024/25 financial year confirmed

The development of the economic environment, and consequently the investment behaviour of companies, remains uncertain. Despite tentative signs of recovery, a fundamental turnaround in economic development has yet to become apparent. Consequently, All for One’s customers continue to operate in an environment characterised by the need to switch to cloud-based business software and a reluctance to commit to long-term investments.

Taking into account the current business situation and order pipeline, the management board is confirming the revised forecast from the beginning of July, expecting revenues of between EUR 505 million and EUR 520 million for the 2024/25 financial year. The EBIT margin before M&A effects (non-IFRS) is expected to be between 5% and 6% of sales revenue.

The medium-term outlook of robust organic growth in the mid-single-digit percentage range has been fundamentally confirmed. However, due to the current heightened geopolitical situation and associated temporary customer restraint, as well as sustained changes within the Customer Experience product area of the LOB segment, the management board now expects the EBIT margin before M&A effects (non-IFRS) to exceed the 8% threshold only in the 2026/27 financial year.

All for One Group SE will publish its full quarterly statement on the 9-month figures for 2024/25 on 7 August 2025.

Turning technology into business success

All for One is a leading international IT consulting and service provider focusing on SAP. As the world’s leading SAP partner for SAP transformations in the midmarket and SAP Cloud Business, the industry specialist supports its customers – including global players, hidden champions and world market leaders – in transforming their businesses. Around 3,000 experts use RISE & GROW with SAP as a digital platform and integrated, AI-based cloud solutions to digitalise business processes, automate workflows and rethink services. More than 4,000 midmarket customers in Germany, Austria, Poland and Switzerland rely on the combination of many years of midmarket experience, SAP expertise and industry and process know-how. All for One’s core industries are mechanical and plant engineering, the automotive supply industry, life sciences, wholesale and professional services.

In financial year 2023/24, All for One generated sales of EUR 511 million. The company is headquartered in Filderstadt near Stuttgart and is listed on the Prime Standard of the Frankfurt Stock Exchange.

Turning technology into business success

All for One is a leading international IT consulting and service provider focusing on SAP. As the world’s leading SAP partner for SAP transformations in the midmarket and SAP Cloud Business, the industry specialist supports its customers – including global players, hidden champions and world market leaders – in transforming their businesses. Around 3,000 experts use RISE & GROW with SAP as a digital platform and integrated, AI-based cloud solutions to digitalise business processes, automate workflows and rethink services. More than 4,000 midmarket customers in Germany, Austria, Poland and Switzerland rely on the combination of many years of midmarket experience, SAP expertise and industry and process know-how. All for One’s core industries are mechanical and plant engineering, the automotive supply industry, life sciences, wholesale and professional services.

In financial year 2023/24, All for One generated sales of EUR 511 million. The company is headquartered in Filderstadt near Stuttgart and is listed on the Prime Standard of the Frankfurt Stock Exchange.

[url=http://www.all-for-one.com/ir-english]www.all-for-one.com/ir-english[/url]

All for One Group SE

Rita-Maiburg-Str. 40

70794 Filderstadt

Telefon: +49 (711) 78807-260

Telefax: +49 (711) 78807-222

http://www.all-for-one.com

Director Marketing & Corporate Communications

Telefon: +49833149831510

E-Mail: anja.brey@all-for-one.com

![]()