– Advertisement/Advertising – This article appears on behalf of Discovery Silver Corp. and Endeavour Silver Corp., companies with which SRC swiss resource capital AG has paid IR consulting contracts. Creator: SRC swiss resource capital AG · Author: Ingrid Heinritzi · First published: 02.09.2025, 3:12 p.m., Europe/Berlin

Nearly 80 percent of silver bars and coins are purchased in India, Germany, Australia, and the US. Looking back over the last 15 years, this area of silver demand has fluctuated between around 157 million and 337 million ounces annually, according to the Silver Institute. Silver investments are increasingly attracting the attention of investors. The precious metal has gained around 34 percent in value this year, outperforming even gold (28 percent).

Global crises, rising government debt, and uncertainty are prompting investors to seek safe investment opportunities. The US ranks first in terms of physical silver investments. Between 2010 and 2024, private investors purchased approximately 1.5 billion ounces of silver. According to a study, little of this was sold, with investors mostly holding on to their silver. In terms of value, these investments accounted for about 70 percent of the value of gold investments.

A significant portion of US silver investments flows into retirement accounts, with room for further growth. India ranks second in the market for physical silver investments. Here, owning silver is a tradition, with silver bars being the most common form of purchase. In India, too, resales were low. Germany ranks third, with demand for physical silver investments expected to be around 25 percent higher this year than last year. In Australia, demand is expected to rise by an estimated 11 percent.

And global silver investments continue to rise this year. As statistics from the Silver Institute show, inflows into silver-backed exchange-traded products already exceed total inflows for 2024. In June, silver was therefore more expensive than it had been in 13 years. Silver is popular. So, it’s time to take a look at silver companies.

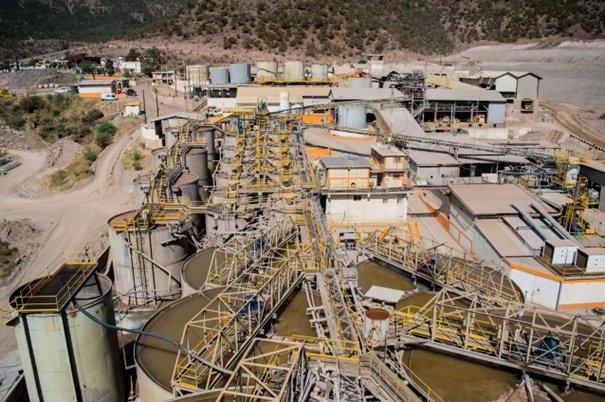

Endeavour Silver – https://www.commodity-tv.com/ondemand/companies/profil/endeavour-silver-corp/ – is one of the successful producers. The company’s projects are located in Mexico, Chile, and Peru. The second quarter brought more ounces sold at higher realized prices.

Discovery Silver – https://www.commodity-tv.com/ondemand/companies/profil/discovery-silver-corp/ – owns the extremely promising Cordero project in Mexico. The reserve amounts to more than 300 million ounces of silver. The company has also recently started producing gold.

Current company information and press releases from Endeavour Silver (- https://www.resource-capital.ch/en/companies/endeavour-silver-corp/ -) and Discovery Silver (- https://www.resource-capital.ch/en/companies/discovery-silver-corp/ -).

Sources:

https://silverinstitute.org/wp-content/uploads/2025/08/Silver-News-AUG2025.pdf https://silverinstitute.org/physical-silver-investment-increasingly-important-to-global-silver-demand/

In accordance with Section 85 of the German Securities Trading Act (WpHG) in conjunction with Article 20 of Regulation (EU) 2016/958 (MAR), we hereby disclose that authors/employees/affiliated companies of SRC swiss resource capital AG may hold positions (long/short) in issuers discussed. Remuneration/relationship: IR contracts/advertorial: Own positions (author): none; SRC net position: less than 0.5%; issuer’s stake in SRC ≥ 5%: no. Update policy: no obligation to update. No guarantee for the translation into German. Only the English version of this news release is authoritative.

Disclaimer: The information provided does not constitute any form of recommendation or advice. We expressly draw attention to the risks involved in securities trading. No liability can be accepted for any damage arising from the use of this blog. We would like to point out that shares and, in particular, warrant investments are generally associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the accuracy of all content. Despite the utmost care, I expressly reserve the right to errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but does not claim to be accurate or complete. Due to court rulings, the content of linked external sites is also our responsibility (e.g., Hamburg Regional Court, in its ruling of May 12, 1998 – 312 O 85/98), as long as we do not expressly distance ourselves from them. Despite careful content control, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of SRC swiss resource capital AG, which is available at https://www.resource-capital.ch/de/disclaimer-agb/, applies additionally.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41764802584

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()