The Bulk Sample program will involve the extraction of up to 2,000 tons of mineralized material over a 12–14-week period (which commenced late December 2025) and will be executed using contract mining services provided by GenX Mining Contractors, LLC of Spring Creek, Nevada. Mineralized material recovered during the program will be transported to the White Mesa Mill in Utah, owned by Energy Fuels Inc., for processing.

With U.S. utilities increasingly focused on securing domestic uranium supply and limited nearterm production capacity available, IsoEnergy believes Tony M represents a rare opportunity to advance a permitted, infrastructure-ready uranium mine toward potential restart without the need for costly and timely mill construction/refurbishment or major permitting initiatives. The Bulk Sample is a critical step in defining the scope and economics of a future production plan at Tony M. This work aligns with U.S. federal initiatives focused on rebuilding domestic nuclear fuel supply chains and enhancing energy security through increased domestic uranium production.

Upon completion of the Bulk Sample, IsoEnergy expects to evaluate the results alongside ongoing optimization studies to determine next steps, which may include advancing detailed mine planning, finalizing restart sequencing, and assessing the timing of a potential production decision.

Highlights

• Bulk Sample Designed as a Decision Gate Toward Potential Restart

o Low-risk, limited-scope program structured to generate real-world mining, processing, and cost data required to evaluate a potential restart decision.

o Results expected to inform mine planning, sequencing, and commercial production assumptions.

• De-Risking Mining Methods and Cost Structure Under Operating Conditions

o Establishes actual contract mining costs and validates assumptions used in economic models.

o Refines mineral material-control strategies to minimize dilution and maximize delivered grade, including testing dilution-control techniques in a production-style environment.

• Processing Pathway Established Through Existing Toll Milling Agreement

o Mineralized material to be processed at the White Mesa Mill, eliminating the need for new mill construction and materially reducing capital intensity and execution risk.

o Enables IsoEnergy to focus capital and effort on mine restart and optimization rather than downstream infrastructure.

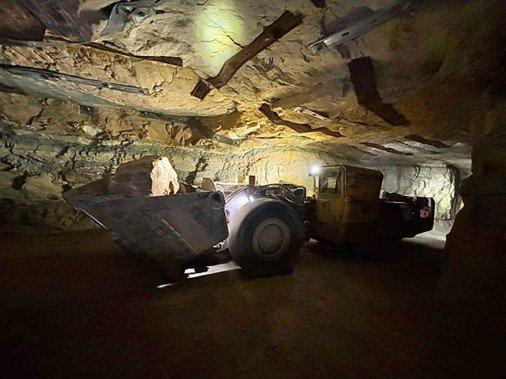

• Production-Ready Underground Systems and Execution Tested

o Trials ventilation, ground-control, and underground operating procedures ahead of full-scale mining.

Philip Williams, CEO and Director of IsoEnergy, commented, “The Bulk Sample at Tony M is a major milestone in advancing one of the few restart-ready uranium mines in the United States. This program is designed to generate the real-world data we need to evaluate a potential full scale production restart under current market conditions. With permitting, infrastructure, and toll milling already in place, Tony M has the potential to be among the next conventional uranium mines in the U.S. to return to production as demand for secure domestic supply continues to grow.”

Progress on Tony M Mine Work Programs

During 2025, IsoEnergy advanced a series of initiatives designed to strengthen the operating and economic profile of Tony M including, reducing the uranium production royalty on the Utah Trust Lands Administration (SITLA) lease from 8% to 3%, High-Pressure Slurry Ablation testing, which has demonstrated the potential to recover more than 90% of the uranium into roughly 25% of the original mass and mineralized material-sorting testwork completed in October which achieved over 90% recovery into roughly 50% of the original mass for material amenable to sorting. In parallel, an enhanced evaporation study has shown that Landshark evaporators eliminate the need for evaporation-pond expansion and reduce both permitting timelines and capital requirements. Together, these work programs support the Company’s strategy of systematically de-risking Tony M and improving the economic framework for a future production decision.

About Tony M Mine

The Tony M Mine is located in eastern Garfield County, southeastern Utah, approximately 66 air miles (107 kilometers) west northwest of the town of Blanding and 215 miles (347 kilometers) south-southeast of Salt Lake City. The project is the site of the Tony M underground uranium mine that was developed by Plateau Resources, a subsidiary of Consumer Power Company, in the mid1970s. Uranium and vanadium mineralization at the Tony M mine is hosted in sandstone units of the Salt Wash Member of the Jurassic age Morrison Formation, one of the principal hosts for uranium deposits in the Colorado Plateau region of Utah and Colorado.

Qualified Person Statement

The scientific and technical information contained in this news release was reviewed and approved by Dean T. Wilton: PG, CPG, MAIG, a consultant of IsoEnergy who is a “Qualified Person” (as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects).

About IsoEnergy Ltd.

IsoEnergy (NYSE American: ISOU; TSX: ISO) is a leading, globally diversified uranium company with substantial current and historical mineral resources in top uranium mining jurisdictions of Canada, the U.S. and Australia at varying stages of development, providing near-, medium- and long-term leverage to rising uranium prices. IsoEnergy is currently advancing its Larocque East project in Canada’s Athabasca basin, which is home to the Hurricane deposit, boasting the world’s highestgrade indicated uranium mineral resource. IsoEnergy also holds a portfolio of permitted pastproducing, conventional uranium and vanadium mines in Utah with a toll milling arrangement in place with Energy Fuels. These mines are currently on standby, ready for rapid restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer.

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of U.S. securities laws (collectively, “forward-looking statements”). Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. These forward-looking statements may relate to details of the Bulk Sample program and planned processing activities and the results thereof; expectations with respect to any potential restart decision with respect to the Company’s US projects and the anticipated timing thereof; permitting, development or other work that may be required to bring any of the projects into development or production; the completion of planned technical studies and the expected results thereof; expectations regarding completion of technical and economic assessments; expectations regarding the Company’s enhanced U.S. market presence; expectations regarding the Company’s engagement with institutional and retail investors; increased demand for and interest in nuclear power and uranium; potential changes in US nuclear policy; and any other activities, events or developments that the Company expects or anticipates will or may occur in the future.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, assumptions that the results of planned exploration and development activities are as anticipated; assumptions that the results of planned technical work programs and technical and economic assessments are as anticipated; the anticipated mineralization of IsoEnergy’s projects being consistent with expectations and the potential benefits from such projects and any upside from such projects; the price of uranium; assumptions regarding uranium market conditions and policy shifts; that general business and economic conditions will not change in a materially adverse manner; that financing will be available if and when needed and on reasonable terms; and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned activities will be available on reasonable terms and in a timely manner. Although IsoEnergy has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Such statements represent the current views of IsoEnergy with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by IsoEnergy, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include, but are not limited to the following: negative operating cash flow and dependence on third party financing; uncertainty of additional financing; no known mineral reserves; aboriginal title and consultation issues; reliance on key management and other personnel; actual results of technical work programs and technical and economic assessments being different than anticipated; changes in development and production plans based upon results; availability of third party contractors; availability of equipment and supplies; failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena; other environmental risks; changes in laws and regulations; regulatory determinations and delays; stock market conditions generally; demand, supply and pricing for uranium; other risks associated with the mineral exploration industry; and general economic and political conditions in Canada, the United States and other jurisdictions where the Company conducts business. Other factors which could materially affect such forwardlooking statements are described in the risk factors in IsoEnergy’s most recent annual management’s discussion and analysis and annual information form and IsoEnergy’s other filings with securities regulators which are available under the Company’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. IsoEnergy does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

Cautionary Note to United States Investors Regarding Presentation of Mineral Resource Estimates

The mineral resource estimates included in this press release have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ in certain material respects from the disclosure requirements promulgated by the U.S. Securities and Exchange Commission (the “SEC”). Accordingly, information contained in this press release may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41764802584

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()