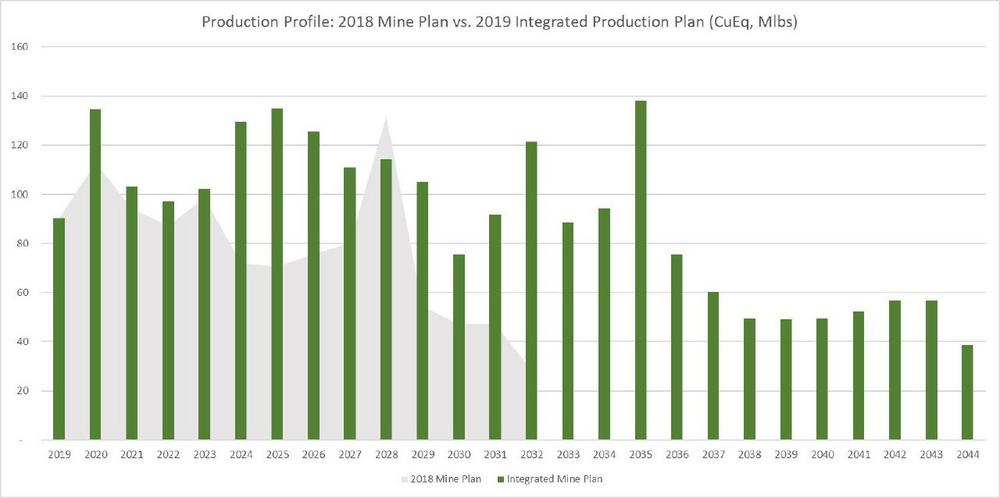

The results include a 102% increase in Mineral Reserves, a 27% increase in average annual copper equivalent production to 116 million pounds (over the first ten years), a 12-year extension in mine life to 26 years and a decrease in C1 cash costs to US$1.87 per pound produced, when compared to the previous CMM production plan included in the Company’s 2018 NI 43-101 Technical Report for the Copper Mountain Mine, filed in November 2018.

The Integrated Production Plan outlines a phased approach to the investments in the mill expansion and New Ingerbelle development. The first phase would be the plant expansion, which requires the installation of a third ball mill. The plant expansion could be completed as early as the first quarter of 2020 and is forecasted to cost approximately US$25 million. The second phase would be for the development of New Ingerbelle, which requires capital of about US$23 million. The after-tax NPV (8%) of the Integrated Production Plan for the Copper Mountain Mine, including both growth projects, is approximately US$619 million. All metrics are on a 100% basis. All Dollars are in U.S. Dollars.

“The new Integrated Production Plan completely transforms the Copper Mountain operations,” states Gil Clausen, Copper Mountain’s President and CEO. “For minimal capital and minimal risk, we have the potential to realize significant value as we expect to increase our annual production, double total life of mine production, extend the mine life and decrease unit costs. These growth projects build upon an already solid operating base allowing us the potential to increase and advance near term cash flow. Over the next ten years the project has no negative cash flow years, and the Company is actively reviewing the replacement of the existing debt packages that would allow for significant cash to be available from cash flows that would enhance overall liquidity for the Company.”

Copper Mountain has filed a NI 43-101 Technical Report for the Copper Mountain Mine (“Technical Report”) containing the new Integrated Production Plan and Mineral Reserve and Mineral Resource estimate on SEDAR (www.sedar.com).

Highlights

Highlights from the Integrated Production Plan, which includes an expansion of the existing mill to 45,000 tpd and the integration of New Ingerbelle, are provided below.

Mining and Processing

The Integrated Production Plan assumes a plant expansion to 45,000 tpd from 40,000 tpd and the integration of the New Ingerbelle pit. The Plan is based on Mineral Reserves only and does not include any other Mineral Resource categories. The Company believes that potential exists to increase production further by converting Resources to Reserves as well as increasing resources through exploration. The Plan stipulates New Ingerbelle ore would be trucked to the Copper Mountain Mine, using CMM’s existing mine equipment fleet, CMM’s expanded 45,000 tpd mill and tailings facility. The Integrated Production Plan assumes the start-up of the third ball mill in the second quarter of 2020.

The current CMM concentrator uses a simple processing flowsheet composed of primary and secondary crushing, and grinding, followed by sulphide rougher/cleaner flotation circuits. The Technical Report plans for the installation of a 22 ft x 38 ft, 12.6 MW ball mill to be integrated into the existing grinding circuit, which would allow for an increase in throughput to 45,000 tpd with a finer grind of about 150 µm. It is envisioned that the mill would operate as a tertiary grinding circuit, installed after the existing two ball mills that operate in parallel and would provide for a larger energy input into the ball milling circuits (See Appendix 2 for Proposed Flowsheet). Decreasing the final grind from 225 µm to 150 µm would allow for higher flotation recoveries, maximizing the value of mined ore tonnes. The Company currently owns the new ball mill and has it stored for a project construction start-up decision.

Further metallurgical testing on the New Ingerbelle pit ore has been completed and has yielded positive results. Samples collected within the final New Ingerbelle pit limits indicate the ore will have improved flotation performance, similar to that of historical New Ingerbelle mill recoveries of 87% to 89%. The testwork indicates copper recovery at New Ingerbelle to be better than the recovery experienced to date at CMM, with higher gold content and recovery. The average life of mine copper recovery is expected to be 85.5%, approximately 5% higher than current levels at CMM.

Total ore mined is expected to be 363 million tonnes and total waste mined is expected to be 663 million tonnes, with an improved strip ratio of 1.82, when compared to the 2018 CMM Mine Plan, of 2.88. Using improved recoveries of 85.5% for copper, 69% for gold and 69% for silver, total production is expected to be 1,895 million pounds of copper, 982,000 ounces of gold and 7.3 million ounces of silver. A summary of mining, processing and production metrics is provided below. A more detailed life of mine production schedule is available in the 2019 Technical Report filed on SEDAR.

Capital and Operating Costs

The initial capital cost required to increase throughput to 45,000 tpd is estimated to be approximately US$25.2 million. This includes the installation of the third ball mill and other required equipment costs but does not include the actual cost of the ball mill as the Company has already purchased the mill. The capital required for the start-up of the New Ingerbelle pit is estimated to be approximately US$22.7 million, the majority of which is for the completion of a short bridge from New Ingerbelle to the Copper Mountain Mine side. The Company expects development of New Ingerbelle to take approximately 24 months. See Appendix 3 for a depiction of the proposed site layout. The Technical Report assumed that pre-stripping for New Ingerbelle would be completed by contract mining and was not included in the initial capital as New Ingerbelle is now integrated into the Copper Mountain Mine production schedule. As required under IFRS, in periods when the stripping ratio exceeds the average life of mine stripping ratio, the excess costs over the mine stripping ratio expected costs would be treated as capital expenditures and amortized. All waste in the life of mine production plan above the average strip ratio in any year is treated as such, including New Ingerbelle development.

Total life of mine sustaining capital for CMM is estimated to be US$214 million. The majority of sustaining capital is related to the replacement of mobile mining equipment.

Average C1 cash costs, net of by product credits, are approximately US$1.74 per pound of copper, for the first ten years starting in 2020, and US$1.87 per pound of copper over the life of mine. Total operating unit costs are estimated to be US$9.92 per tonne milled, which includes mining costs of US$2.10 per tonne mined and processing costs of US$4.44 per tonne milled. A unit cost breakdown is provided below.

All capital and operating costs assume a long-term Canadian Dollar exchange rate to U.S. Dollar exchange rate of 1.32 to 1.

Project Economics

The after-tax NPV for the mill expansion and integration of New Ingerbelle, assuming an 8% discount rate, is US$619 million. The economics are based on a Canadian Dollar to U.S. Dollar exchange rate of 1.32 to 1 and consensus metal pricing that varies over the initial four years and has long-term metal prices of US$3.18 per pound copper, US$1,314 per ounce of gold and US$17.75 per ounce of silver. A sensitivity analysis on varying long-term copper prices was completed on the after-tax NPV (8%) and the results are summarized below.

Mineral Reserves and Mineral Resources

The Copper Mountain Operation Mineral Reserve more than doubled when compared to the September 1, 2018 Mineral Reserve. The Mineral Reserve is included in the Mineral Resource and the effective date of the Mineral Reserve and Mineral Resource is January 1, 2019. A summary of the Mineral Reserve and Mineral Resource is provided below.

Competent Persons Statement

The information in this report that relates to Exploration Targets, Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Peter Holbek, B.SC (Hons), M.Sc., P. Geo. Mr. Holbek is a full time employee of the Company and has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr. Holbek does consent to the inclusion in this news release of the matters based on their information in the form and context in which it appears.

Qualified Persons

The Mineral Resource estimate for the Copper Mountain mine was prepared by Mr. Peter Holbek, B.Sc (Hons), M.Sc., P. Geo, who is the Vice President, Exploration of Copper Mountain Mining Corporation. Mr. Holbek serves as the Qualified Person as defined by National Instrument 43-101. Mr. Holbek consents to the inclusion of the mineral resource in this news release and has approved the mineral resource information included in this news release.

Mr. Stuart Collins, P.E., serves as the Qualified Person as defined by National Instrument 43-101 and is the Qualified Person for information regarding the Copper Mountain Mine’s Technical Information and Mineral Reserve. Mr. Collins is independent of the Company and has reviewed and approved the contents of this news release.

About Copper Mountain Mining Corporation:

Copper Mountain’s flagship asset is the 75% owned Copper Mountain mine located in southern British Columbia near the town of Princeton. The Copper Mountain mine currently produces approximately 90 million pounds of copper equivalent, with production increasing to over 100 million pounds of copper equivalent a year in 2020. Copper Mountain also has the permitted, development-stage Eva Copper Project in Queensland, Australia and an extensive 4,000 km2 highly prospective land package in the Mount Isa area. Copper Mountain trades on the Toronto Stock Exchange under the symbol “CMMC” and Australian Stock Exchange under the symbol “C6C”.

Additional information is available on the Company’s web page at www.CuMtn.com.

On behalf of the Board of COPPER MOUNTAIN MINING CORPORATION “Gil Clausen”

Gil Clausen, P.Eng. Chief Executive Officer

Forward-looking Statements

Note: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results. This press release includes expected results from the Integrated Production Plan for the Copper Mountain Mine but is still subject to a construction decision by the Company’s Board of Directors and the Company’s partner, Mitsubishi Materials Corporation (MMC). Readers are referred to the documents, filed by the Company on SEDAR at www.sedar.com, specifically the most recent reports which identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company undertakes no obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statement.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Vice President Corporate Development & Investor Relations

Telefon: 1 (604) 682-2992

E-Mail: letitia.wong@cumtn.com

Investor Relations

Telefon: 1 (604) 682-2992

E-Mail: Dan@CuMtn.com