Highlights from the updated mine plan and Mineral Reserve and Mineral Resource include:

- Increased Proven and Probable Mineral Reserve by 12% to 477 million tonnes for contained metal of 2.47 billion pounds of copper and 1.55 million ounces of gold (at average grades of 0.23% Cu and 0.10 g/t Au)

- Life of mine strip ratio reduced to 1.58 from 1.82

- Mine life increased by 4.5 years to 31 years at current planned production levels

Gil Clausen, Copper Mountain’s President and CEO stated, “We continue to grow the size and quality of the Copper Mountain Mine Mineral Reserves. Over the last year we have integrated the New Ingerbelle pit and now we have increased and integrated the CMM North pit as well as optimized the CMM Main pit. The North pit brings low cost production given it is mineralized from surface and adjacent to the Copper Mountain Mine’s mid-grade and low-grade stockpiles and the primary crusher. Notably, the North pit requires zero initial capital to develop and has a low strip ratio of 0.85 waste tonnes to ore tonnes, which, when combined with the new design optimizations of the established pits, decreases total life of mine strip ratio for the entire operation to 1.58 from 1.82.”

Mr. Clausen added, “We will continue to drill the resources at the Copper Mountain Mine as significant potential exists to further expand all the deposits at a low conversion and discovery cost. Given the positive impact that the CMM North pit could have on near term production cost, we have adjusted our current mine plan to accommodate some production commencing from CMM North starting later in 2020. The bulk of production in 2020 and over the next several years is still expected to come from higher grade zones in the CMM Main pit. With the planned completion of our mill expansion project, which is currently underway, the new mine plan will allow for a more consistent, higher production rate at lower cost in the near, medium and longer term.”

Mineral Reserve and Mineral Resource

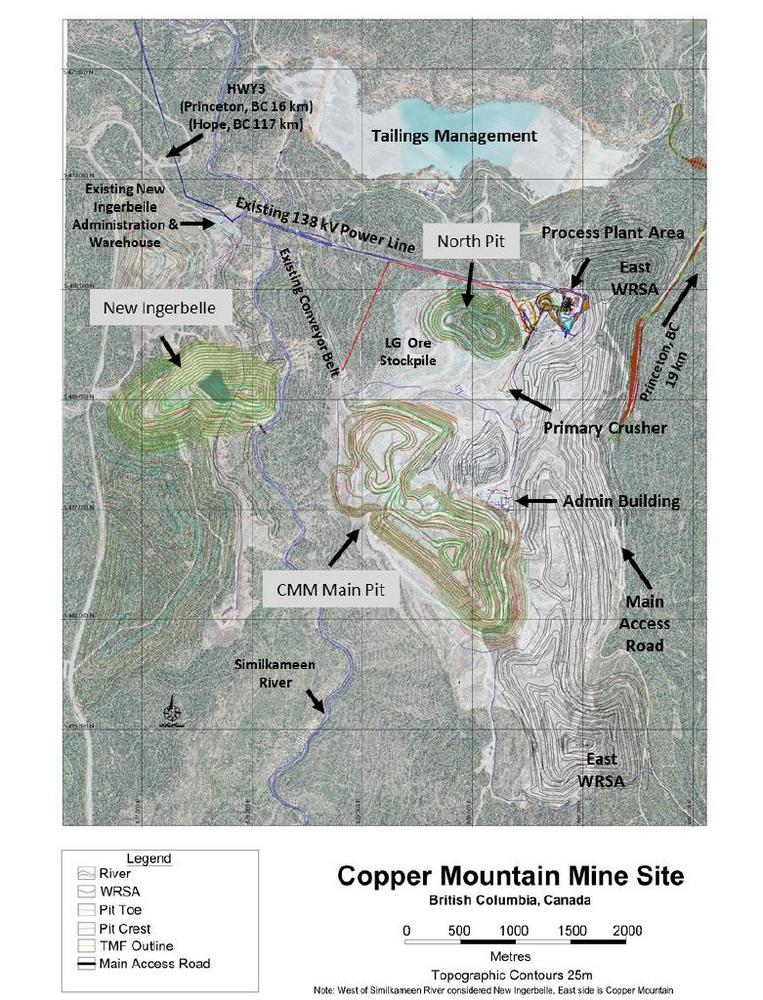

As a result of the 2019 exploration and development drilling at the Copper Mountain Mine, the Company has increased the Mine’s Mineral Reserve and Mineral Resource across all categories when compared to the last published February 2019 Mineral Reserve and Mineral Resource, including depletion from production to the end of July 2019. A summary of the Copper Mountain Mine Mineral Reserve and Mineral Resource, which includes the CMM Main pit, CMM North pit and the New Ingerbelle pit is provided below. See Appendix 1 for site and pit location overview. See Appendix 2 for Mineral Reserve by pit and grade tabulation and Mineral Resource by pit. The Mineral Reserve is included in the Mineral Resource and the effective date of the Mineral Reserve and Mineral Resource is August 1, 2019.

Mineral Reserve Notes: Mineral Reserve Notes:

1. Joint Ore Reserves Committee (JORC) and CIM Definition Standards were followed for Mineral Reserves.

2. Mineral Reserves were generated using the August 1, 2019 mining surface.

3. Mineral Reserves are reported at a 0.10% Cu cut-off grade based on an Equivalent NSR cut-off.

4. Mineral Reserves are reported using long-term copper, gold, and silver prices of $2.75/lb, $1,300/oz, and $16.50/oz, respectively.

5. To define Mineral Reserves, average copper process recoveries of 80% for Main Pit and 88.5% for Main Pit North, gold process recovery of 65% and silver process recovery of 70%.

6. Average bulk density is 2.78 tonnes per cubic metre (t/m3).

7. Stockpile grades are approximations based on grade control results.

8. Stockpile tonnes and grade based on production grade control process.

Mineral Resource Notes:Mineral Resource Notes:

1. Joint Ore Reserves Committee (JORC) and CIM Definition Standards were followed for Mineral Resources.

2. Mineral resources were estimated between the August 1, 2019 mining/topographic surface and Whittle Pit shell generated using US$3.50/lb Cu price

3. Mineral Resources are reported at the 0.10% Cu cut-off (Mineral Reserve) grade and various process cut-off grades dependant on NSR value the mineralization.

4. Average bulk density is 2.78 tonnes per cubic metre (t/m3).

Mine Plan

The Company has updated and optimized the CMM Main Pit and the CMM North Pit, which resulted in lowering the strip ratio (waste to ore) to 1.58. This ratio is lower than the previous February 2019 average life of mine strip ratio of 1.82. The new pit designs, which include the incorporation of the expanded North pit into the production sequence, have enhanced the consistency of production and cost over the plan outlined in the Company’s Technical Report dated February 2019. The Company plans to provide three-year production and cost guidance in January 2020. A summary of mining metrics compared to the prior February 2019 mine plan is provided below:

Competent Persons Statement

The information in this report that relates to Exploration Targets, Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Peter Holbek, B.SC., M.Sc. P. Geo. Mr. Holbek is a full time employee of the Company and has sufficient experience, which is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr. Holbek does consent to the inclusion in this news release of the matters based on their information in the form and context in which it appears.

Qualified Person

The Mineral Resource estimate was prepared by Mr. Peter Holbek, B.Sc., M.Sc., P. Geo, who is the Vice President, Exploration of Copper Mountain Mining Corporation. Mr. Holbek serves as the Qualified Person as defined by National Instrument 43-101. Mr. Holbek consents to the inclusion of the mineral resource in this news release and has approved the mineral resource information included in this news release.

Mr. Stuart Collins, P.E., serves as the Qualified Person as defined by National Instrument 43-101 and is the Qualified Person for information regarding the Copper Mountain Mine’s Mineral Reserve. Mr. Collins is independent of the Company and has reviewed and approved the contents of this news release in relation to the Mineral Reserve.

About Copper Mountain Mining Corporation

Copper Mountain’s flagship asset is the 75% owned Copper Mountain mine located in southern British Columbia near the town of Princeton. The Copper Mountain mine currently produces approximately 90 million pounds of copper equivalent, with average annual production expected to increase to over 110 million pounds of copper equivalent. Copper Mountain also has the permitted, development-stage Eva Copper Project in Queensland, Australia and an extensive 4,000 km2 highly prospective land package in the Mount Isa area. Copper Mountain trades on the Toronto Stock Exchange under the symbol “CMMC” and Australian Stock Exchange under the symbol “C6C”.

Additional information is available on the Company’s web page at www.CuMtn.com.

On behalf of the Board of

COPPER MOUNTAIN MINING CORPORATION

“Gil Clausen”

Gil Clausen, P.Eng.

Chief Executive Officer

For further information, please contact:

Letitia Wong, Vice President Corporate Development & Investor Relations

604-682-2992 Email: letitia.wong@cumtn.com or

Dan Gibbons, Investor Relations 604-682-2992 ext. 238 Email: dan.gibbons@CuMtn.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Website: www.CuMtn.com

Note: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results. Readers are referred to the documents, filed by the Company on SEDAR at www.sedar.com, specifically the most recent reports which identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company undertakes no obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statement.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()