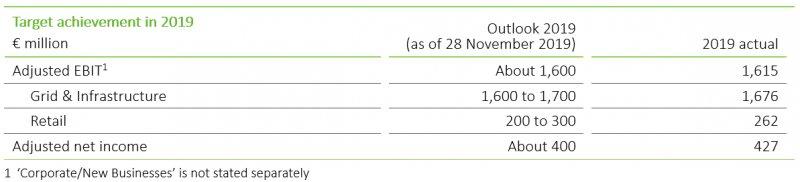

- Adjusted EBIT at around €1.6 billion

- Adjusted net income at around €0.4 billion

innogy SE closed fiscal 2019 below the previous year, as anticipated, and achieved the outlook amended in November 2019. The company recorded adjusted EBIT amounting to €1,615 million, which was around 23 percent below the previous year’s figure. Adjusted net income amounted to €427 million, a reduction of around 39 percent. The main reasons for the decline in results were regulatory interventions in the British retail business in relation to introducing the price cap for standard tariffs and intense competitive pressure. Furthermore, higher grid fees and wholesale prices for electricity and gas in the German retail business were not fully passed on to the customers. In the Grid & Infrastructure division, earnings were reduced due to the sale of the Czech gas grid business at the end of February 2019.For details of the business performance, please refer to the Annual Report 2019, available at www.innogy.com/annual-report-2019.

innogy’s takeover by E.ON led to significant structural effects in terms of reporting. The business activities to be sold to RWE in relation to innogy’s takeover by E.ON were moved to the segment ‚Divestment Business‘ and stated as discontinued operations since the nine months 2019 statement. These structural effects had an impact on the outlook for fiscal 2019, as the operations in the Divestment Business segment no longer contribute to the consolidated figures for adjusted EBIT and adjusted net income, among other things. Consequently, in November 2019 innogy adjusted the previous forecast to reflect these effects.

Takeover of innogy by E.ON

On 4 March 2020, the Extraordinary General Meeting agreed to the squeeze-out request of the majority shareholder E.ON and approved the cash compensation of €42.82 per innogy share for the remaining minority shareholders.

Capital expenditure declines slightly year on year

During the reporting period, capital expenditure fell by €41 million to €1,856 million. Most of the expenditure went towards the expansion and modernisation of network infrastructure in Germany. Additionally, there was significant spending to expand the company’s broadband activities. Furthermore, innogy posted considerably higher proceeds from disposals of assets and divestitures, primarily relating to the sale of the Czech gas business.

Total net debt of €19.2 billion

As at 31 December 2019, the net debt of continuing operations amounted to €17.9 billion, while the net debt of discontinued operations stood at €1.3 billion. One reason for the increase in net financial debt was the first-time application of IFRS 16, which means that the statement of leasing liabilities has a negative effect on net debt, and another was the budget deficit. As discount rates fell from 1.8 percent to 1.3 percent in Germany and from 2.8 percent to 2.1 percent in the United Kingdom during the reporting period, provisions for pensions rose. Provisions for wind farm decommissioning are now mostly reported in the net debt of discontinued operations.

Number of employees dropped

As at 31 December 2019 innogy employed a workforce of 34,523 in the Group as a whole. Part-time positions were considered in these figures on a pro-rata basis. Compared to 31 December 2018, the number of employees thus fell by 2,851. The decline is primarily due to the sale of the Czech gas grid business in the first quarter.

Legal disclaimer

This document contains forward-looking statements. These statements are based on the current views, expectations, assumptions and information of the management, and are based on information currently available to the management. Forward-looking statements shall not be construed as a promise for the materialisation of future results and developments and involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those described in such statements due to, among other things, changes in the general economic and competitive environment, risks associated with capital markets, currency exchange rate fluctuations, changes in international and national laws and regulations, in particular with respect to tax laws and regulations, affecting the Company, and other factors. Neither the Company nor any of its affiliates assumes any obligations to update any forward-looking statements.

innogy SE

Opernplatz 1

45128 Essen

Telefon: +49 (201) 12-02

Telefax: +49 (201) 12-20000

http://innogy.com

Pressesprecherin

Telefon: +49 (201) 12-15140

E-Mail: vera.buecker@innogy.com

Pressesprecherin

Telefon: +49 (201) 12-48728

E-Mail: inga.reske@innogy.com

![]()