2020 Highlights

- Earned 66,113 GEOs1 in 2020, above revised guidance of 63,500 – 65,500 GEOs;

- Record revenues from royalties and streams of $156.6 million (2019 – $140.1 million);

- Record cash flows from operations of $108.0 million, an increase of 18% compared to 2019;

- Cash operating margin2 of 94% from royalties and streams;

- Net earnings attributable to Osisko’s shareholders of $16.9 million, or $0.10 per share; and

- Adjusted earnings3 of $43.7 million, or $0.27 per basic share (2019 – $41.9 million, $0.28 per basic share).

Q4-2020 Highlights

- Earned 18,829 GEOs1, excluding 1,754 GEOs from the Renard diamond stream;

- Record revenues from royalties and streams of $48.8 million (Q4 2019 – $38.9 million);

- Cash flows from operating activities of $32.6 million (Q4 2019 – $17.2 million);

- Cash operating margin2 of 94% from royalty and stream interests;

- Net earnings attributable to Osisko’s shareholders of $4.6 million, $0.03 per basic share; and

- Adjusted earnings3 of $12.0 million or $0.07 per basic share (Q4 2019 – $10.3 million, $0.07 per basic share);

Sandeep Singh, President and CEO of Osisko commented on the activities of the fourth quarter of 2020: “Despite mine shutdowns associated with COVID-19 in the first half of the year, Osisko achieved record revenues and cash flows. Our asset base is performing well, with several recent positive developments, including a major catalyst on the Odyssey underground project extending production from our flagship Canadian Malartic asset for decades. Elsewhere, our partners are replacing reserves, extending mine lives, outlining new discoveries and announcing, or further justifying, mine expansions. The fourth quarter marked the last quarter where we invested directly into the Cariboo project. Through the creation of Osisko Development, we added significant value while simplifying our business going forward. We start the year in excellent shape to unlock value for shareholders.”

Other Highlights

- Completed the spin-out of mining assets and certain equity positions through a reverse take-over (“RTO”) transaction and the creation of a North American gold development company, Osisko Development Corp. (“Osisko Development”), which concurrently completed a $100.1 million bought deal financing;

- In December 2020, Osisko Development closed a brokered private placement for gross proceeds of $40.2 million and received proceeds of $73.9 million from a private placement that closed in 2021 (for a total additional financing of $79.8 million);

- In October 2020, Osisko announced a strategic partnership with Regulus Resources Inc. (“Regulus”) whereby Regulus has agreed to grant Osisko an initial NSR royalty of 0.75% – 1.5% on the Mina Volare claim, part of the larger AntaKori project, as well as certain future royalty rights in exchange for an upfront cash payment of US$12.5 million ($16.4 million);

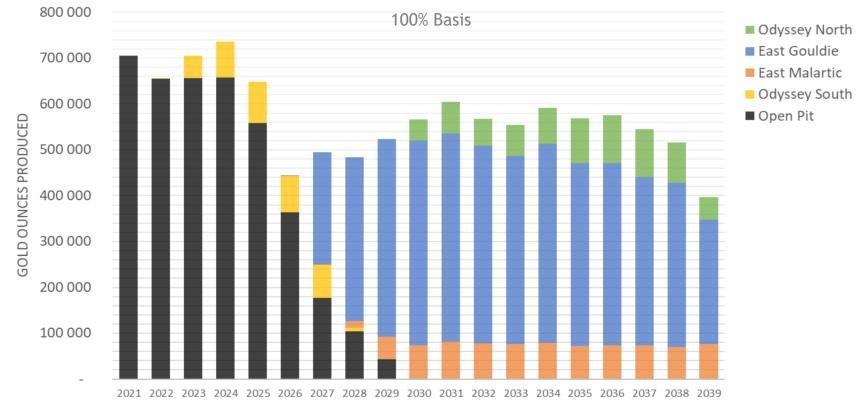

- In February 2021, Agnico Eagle Mines Limited (“Agnico Eagle”) and Yamana Gold Inc. (“Yamana”) announced a positive construction decision for the Odyssey underground mine project. The preliminary economic study shows a total of 7.29 million ounces of additional gold in the mine plan (6.18 million tonnes grading 2.07 g/t gold indicated resources and 75.9 million tonnes grading 2.82 g/t gold inferred resources). Underground mine production is planned to start in 2023 and is expected to ramp up to an average of 545,400 ounces of gold per year from 2029 to 2039;

- On February 12, 2021, Osisko repaid a $50.0 million convertible debenture and drew its credit facility for the same amount, thereby reducing the interest payable by approximately 1.5% per annum; and

- Declared a quarterly dividend of $0.05 per common share payable on April 15, 2021 to shareholders of record as of the close of business on March 31, 2021.

2021 Guidance

Osisko’s 2021 guidance on royalty, stream and offtake interests is largely based on publicly available forecasts from our operating partners. When publicly available forecasts are not available, Osisko obtains internal forecasts from the producers or uses management’s best estimate.

GEOs and cash margin by interest, excluding the Renard stream, are estimated as follows for 2021: (see attached pdf file)

For the 2021 guidance estimate, deliveries of silver and cash royalties have been converted to GEOs using commodity prices of US$1,800 per ounce of gold, US$25 per ounce of silver and an exchange rate (USD/CAD) of 1.28. Any GEOs (and the related cash margin) from the Renard diamond stream have been excluded from the outlook above. For 2021, deliveries from the Renard diamond stream are estimated to be 8,126 GEOs; however, for the remainder of 2021, Osisko has committed to reinvest the net proceeds from the stream through the bridge loan facility provided to the operator.

Cash Balance

The Q4 results mark the first quarter where Osisko is consolidating financial results to include Osisko Development and its subsidiaries. As at December 31, 2020 and 2019, the cash positions in each entity were as follows: (see attached pdf file)

In addition, on February 24, 2021, the Company has access to the undrawn portion of its credit facility of $286.4 million, excluding the additional $100.0 million accordion.

Recent Asset Advancements

Canadian Malartic Underground Construction Decision

Agnico Eagle and Yamana have approved construction of the Odyssey underground project at the Canadian Malartic mine. The preliminary economic assessment estimates 545,000 ounces of gold per annum from 2029 onwards (see Chart 1). The underground production plan of the Odyssey project outlined in the preliminary economic assessment comprises 6.88 million ounces of inferred resources (75.9 million tonnes of 2.82 g/t gold) and 0.41 million ounces of indicated resources (6.18 million tonnes of 2.07 g/t gold). The production plan is hosted in three main underground-mineralized zones; East Gouldie, East Malartic, and Odyssey, the latter of which is sub-divided into the Odyssey North, Odyssey South and Odyssey Internal zones. Osisko holds a 5% NSR royalty on East Gouldie, Odyssey South and the western half of East Malartic and a 3% NSR royalty on Odyssey North and the eastern half of East Malartic.

Osisko Development Corp. Update

Osisko Development announced drill results that help outline the 1.5 kilometres (“km”) long Proserpine zone as another potential mining area in the Cariboo camp. Results include 17.78 g/t gold over 5.6 metres and 8.06 g/t gold over 1.7 metre. There are currently ten surface drills active on the property.

Osisko Development is currently mining underground at the Bonanza Ledge Phase 2 project and is stockpiling mineralized material at the QR Mill. Processing is set to begin in the second quarter of this year. Osisko Development purchased a new communition circuit designed to process 7,500 tonnes per day for the larger Cariboo project. This critical equipment reduces engineering risk and will help fast track the construction of the processing facilities once all permits are received for the Cariboo project.

At the San Antonio gold project, Osisko Development has completed the engineering and permitting to process the 1.3 million tonnes gold mineralized stockpile via heap leaching. Osisko Development has also entered into an agreement to purchase a semi-portable crushing plant for the San Antonio gold project with capacity of 15,000 tonnes per day.

Osisko retains 77.0% of the common equity in Osisko Development and also holds a 5% NSR on the Cariboo and Bonanza Ledge Phase 2 properties as well as a 15% gold and silver stream on the San Antonio gold project with a transfer payment equal to 15% of the spot gold and silver price.

Eagle Ramp-Up

Victoria Gold Corp.’s (“Victoria”) Eagle mine, in the Yukon, produced 116,644 ounces of gold in 2020 and is expected to continue to ramp up production in 2021 towards a run rate of 210,000 oz per annum. Fourth quarter production reached 42,436 ounces of gold which is a 20% increase over the previous quarter. Ore stacking rates improved significantly in the fourth quarter prior to the planned 90-day curtailment of ore staking for the coldest months of the year. Mining operations, primary crushing and stockpiling of ore will continue. Osisko has a 5% NSR royalty on the Eagle mine.

Windfall Resource Update

Osisko Mining Inc. (“Osisko Mining”) released an updated resource estimate on February 17, 2021 for its Windfall project including indicated resources of 1.9 million ounces (6 million tonnes of 9.6 g/t gold) and inferred resources of 4.2 million ounces (16.4 million tonnes of 8 g/t gold). This represents a 54% increase in measured and indicated ounces. More than 30 drill rigs are focused on infill drilling on Lynx where over 60% of the total mineral resources are contained, with average grades of over 11 g/t gold in the measured and indicated categories and 9.9 g/t gold in the inferred category. The Company has a 2-3% NSR royalty on the Windfall deposit, and also owns 14.5% of the outstanding shares of Osisko Mining.

Island Gold Resources Increase

Alamos Gold Inc. (“Alamos”) released an updated resource and reserve estimate on their Island Gold mine highlighted by an 8% increase in reserves and a 40% increase in inferred resources. Proven and probable reserves include 1.3 million ounces (4.2 million tonnes of 9.71 g/t gold) and Inferred resources grew to 3.2 million ounces (6.9 million tonnes of 14.43 g/t gold). The new mineral inventory shows significant upside potential to the Phase III Expansion Study published in July 2020. Osisko has a 1.38% to 3% NSR royalty over the Island Gold mine.

Ermitaño Fully Permitted

First Majestic plans to release a Preliminary Economic Assessment and updated resource estimate for Ermitaño by the end of the first quarter of 2021. The Prefeasibility study is expected to be released in the second half of 2021 and will define initial reserves, production rates, costs and estimated life of mine for the Ermitaño project. First Majestic is preparing for initial limited production in the second half of 2021 followed by production ramp up in early 2022. The land use permit was received in January 2021 completing full permitting of the project. Osisko has a 2% NSR royalty on the Ermitaño project.

Agnico Eagle Increases Exploration Budget on Kirkland Lake Property

Agnico Eagle announced plans to drill 36,500 metres at the Upper Beaver project in 2021, including additional shallow drilling to test an open pit concept and further deep drilling to convert mineral resources to mineral reserves. As of December 31, 2020, Upper Beaver has approximately 1.4 million ounces of gold and 20,000 tonnes of copper in underground probable mineral reserves (8.0 million tonnes grading 5.43 g/t gold and 0.25% copper). Agnico Eagle’s Kirkland Lake property also hosts the Upper Canada, AK and Anoki-McBean deposits which together with Upper Beaver host an additional indicated resource of 1.71 million ounces (17.2 million tonnes of 3.09 g/t gold) and inferred resources of 4.07 million ounces (32.2 million tonnes of 3.93 g/t gold). An internal technical study at Upper Beaver, incorporating drill results from 2020 and 2021, is expected to be completed by the end of 2021. Osisko has a 2% NSR royalty on the Kirkland Lake property.

Agnico Eagle Declares Reserves on Hammond Reef

Agnico Eagle completed an internal technical study, which resulted in the declaration of open pit mineral reserves estimated at 3.32 million ounces of gold (123.5 million tonnes grading 0.84 g/t gold). In addition, the project contains 2.3 million ounces of measured and indicated mineral resources (133.4 million tonnes grading 0.54 g/t gold). Agnico Eagle will continue optimizing the project and potential mining scenarios to further improve project economics. Osisko has 2% NSR royalty on the Hammond Reef property.

Eldorado Gold Declares Maiden Resource on Ormaque and Acquisition of QMX Gold Corporation

In February 2021, Eldorado Gold Corporation (“Eldorado”) declared the maiden resource for the Ormaque deposit. The deposit contains inferred resources of 0.8 million ounces (2.62 million tonnes of 9.5g/t gold) with more than 60% occurring above 400m depth. The top of the deposit occurs at the level of the ore haulage decline that should reach the Ormaque deposit in Q3 of this year. Eldorado aims to provide additional ore sources to optimize the Sigma Mill, which has a permitted capacity of 5,000 tonnes per day, far exceeding current usage of 2,200 tonnes per day. Osisko has a 1% NSR royalty on the Lamaque property hosting the Ormaque deposit.

In January 2021, Eldorado announced the friendly acquisition of QMX Gold Corporation (QMX). Osisko holds a 2.5% royalty over most of the QMX property, including the three main exploration targets. The most advanced of these targets is Bonnefond, which hosts indicated resources of 0.4 million ounces (7.4 million tonnes of 1.67 g/t gold) and inferred resources of 0.29 million ounces (3.3 million tonnes of 2.71 g/t gold). Recent drilling results (including 5.46 g/t gold over 33.5 metres) illustrate significant underground exploration potential.

Casino Gold Zone

Western Copper and Gold (“Western Copper”) released exploration results on the Casino project highlighting significantly higher grades in the deposit core from surface to greater than 200 metres depth. Drill results include 0.76 g/t gold over 175.49 metres; these results will be integrated in an updated preliminary economic assessment to be released in the second quarter of 2021. Osisko holds a 2.75% NSR royalty on the Casino project.

Wharekirauponga (WKP)

Oceana Gold Corp. (“Oceana”) released some spectacular drill intersections on their WKP project including 22.8 g/t gold and 39 g/t silver over 48.9 metres and 41.4 g/t gold and 81.6 g/t silver over 9 metres. Approximately 10,500 metres of drilling are planned in 2021. Oceana continues to advance the consenting process to access this zone for underground mining. Osisko has a 2% NSR on the WKP property.

Bralorne Drilling

Talisker Resources Ltd. (“Talisker”) continues to intersect high grade vein intersections on their Bralorne property, but also some thicker bulk mining intervals. The Charlotte zone includes 10.47 g/t gold over 10.30 metres at a depth of 102.7 metres and 1.55 g/t gold over 36.95 metres at a depth of 208.45 metres. Talisker initiated a 50,000 metre drill program at Bralorne in 2021. Osisko has a 1.2% NSR on the Bralorne property.

Q4 2020 and Full Year 2020 Results Conference Call

Osisko will host a conference call on Thursday, February 25, 2021 at 10:00 am EST to review and discuss its fourth quarter and full year 2020 results and 2021 guidance.

Those interested in participating in the conference call should dial in at 1-(833) 979-2852 (North American toll free), or 1-(236) 714-2915 (international). An operator will direct participants to the call.

The conference call replay will be available from 1:00 pm EST on February 25, 2021 until 11:59 pm EST on March 4, 2021 with the following dial in numbers: 1-(800) 585-8367 (North American toll free) or 1-(416) 621-4642, access code 9484419. The replay will also be available on our website at www.osiskogr.com.

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Guy Desharnais, Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold Royalties Ltd, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

About Osisko Gold Royalties Ltd

Osisko Gold Royalties Ltd is an intermediate precious metal royalty company focused on the Americas that commenced activities in June 2014. Osisko holds a North American focused portfolio of over 140 royalties, streams and precious metal offtakes. Osisko’s portfolio is anchored by its cornerstone asset, a 5% net smelter return royalty on the Canadian Malartic mine, which is the largest gold mine in Canada.

Osisko’s head office is located at 1100 Avenue des Canadiens-de-Montréal, Suite 300, Montréal, Québec, H3B 2S2.

For further information, please contact Osisko Gold Royalties Ltd:

Heather Taylor

Vice President, Investor Relations

Tel. (514) 940-0670 x105

htaylor@osiskogr.com

Forward-looking Statements

This news release contains forward-looking information and forward-looking statements (together, "forward‑looking statements") within the meaning of applicable Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995. All statements in this release, other than statements of historical fact, that address future events, developments or performance that Osisko expects to occur including management’s expectations regarding Osisko’s growth, results of operations, estimated future revenue, requirements for additional capital, production estimates, production costs and revenue, business prospects and opportunities are forward-looking statements. In addition, statements relating to gold equivalent ounces ("GEOs"), especially as they relate to production guidance for 2021, are forward‑looking statements, as they involve implied assessment, based on certain estimates and assumptions, and no assurance can be given that the GEOs will be realized. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "is expected" "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential", "scheduled" and similar expressions or variations (including negative variations of such words and phrases), or may be identified by statements to the effect that certain actions, events or conditions "will", "would", "may", "could" or "should" occur including, without limitation, the performance of the assets of Osisko, the timely construction of and production from the Odyssey underground project, the timely development of the Cariboo project and Bonanza Ledge Phase 2 project and results from the exploration work, the timely development and construction of the San Antonio project, the continued ramp up of the Eagle Mine, the results from exploration work at the Windfall project, the timely release of a Preliminary Economic Assessment and of a Prefeasibility study by First Majestic and the positive outcome thereof, the results from exploration work at the Kirkland Lake property and positive results from optimization of the Hammond Reef project, and positive exploration results from other properties over which Osisko holds an interest, , that significant value will be created within the accelerator group of companies and Osisko’s ability to seize future opportunities. Although Osisko believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements involve known and unknown risks, uncertainties and other factors and are not guarantees of future performance and actual results may accordingly differ materially from those in forward-looking statements. Factors that could cause the actual results deriving from Osisko’s royalties, streams and other interests to differ materially from those in forward-looking statements include, without limitation: the uncertainties related to the COVID-19 impacts, the influence of political or economic factors including fluctuations in the prices of the commodities and in value of the Canadian dollar relative to the U.S. dollar, continued availability of capital and financing and general economic, market or business conditions; regulations and regulatory changes in national and local government, including permitting and licensing regimes and taxation policies; whether or not Osisko is determined to have “passive foreign investment company” (“PFIC”) status as defined in Section 1297 of the United States Internal Revenue Code of 1986, as amended; potential changes in Canadian tax treatments of offshore streams or other interests, litigation, title, permit or license disputes; risks and hazards associated with the business of exploring, development and mining on the properties in which Osisko holds a royalty, stream or other interest including, but not limited to development, permitting, infrastructure, operating or technical difficulties, unusual or unexpected geological and metallurgical conditions, slope failures or cave-ins, flooding and other natural disasters or civil unrest, rate, grade and timing of production differences from mineral resource estimates or production forecasts or other uninsured risks; risk related to business opportunities that become available to, or are pursued by Osisko and exercise of third party rights affecting proposed investments. The forward-looking statements contained in this press release are based upon assumptions management believes to be reasonable, including, without limitation: the ongoing operation of the properties in which Osisko holds a royalty, stream or other interest by the owners or operators of such properties in a manner consistent with past practice; the accuracy of public statements and disclosures made by the owners or operators of such underlying properties; no material adverse change in the market price of the commodities that underlie the asset portfolio; Osisko’s ongoing income and assets relating to the determination of its PFIC status, no material changes to existing tax treatments; no adverse development in respect of any significant property in which Osisko holds a royalty, stream or other interest; the accuracy of publicly disclosed expectations for the development of underlying properties that are not yet in production; and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. However, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Investors are cautioned that forward-looking statements are not guarantees of future performance. Osisko cannot assure investors that actual results will be consistent with these forward-looking statements and investors should not place undue reliance on forward-looking statements due to the inherent uncertainty therein.

For additional information with respect to these and other factors and assumptions underlying the forward-looking statements made in this press release, see the section entitled "Risk Factors" in the most recent Annual Information Form of Osisko which is filed with the Canadian securities commissions and available electronically under Osisko’s issuer profile on SEDAR at www.sedar.com and with the U.S. Securities and Exchange Commission on EDGAR at www.sec.gov. The forward-looking information set forth herein reflects Osisko’s expectations as at the date of this press release and is subject to change after such date. Osisko disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()