The 1,207,000 ounce inferred mineral resource consists of an:

- Open pit constrained inferred mineral resource of 21.8 million tonnes averaging 1.25 g/t for 876,000 ounces of contained gold, and an

- Underground inferred mineral resource of 2.55 million tonnes averaging 4.04 g/t for 331,000 ounces of contained gold.

President and CEO David Suda stated, “We are pleased to announce the significantly expanded inferred mineral resource for the YCG Project, which demonstrates the growth potential of this project to all stakeholders. With a 1.2 million ounce inferred mineral resource, the mineralized system is open for further expansion in most directions. Currently, our focus is drilling the unexplored potential of the Campbell Shear structure which produced more than five million ounces of high-grade gold at the Con Mine. The Campbell Shear drilling, which commenced in late 2020, has the potential to demonstrate that our district scale YCG Project may host multiple deposits.”

To hear about the updated inferred mineral resource and the YCG Project, please join us at our webinar event:

Adelaide Capital Hosts Gold Terra Update

Webinar Registration Click Here

Topic: Update by Gerald Panneton and David Suda

Date and Time: March 17, 2021 03:00 PM Eastern Time (US and Canada)

The 2021 updated mineral resources and its upside potential

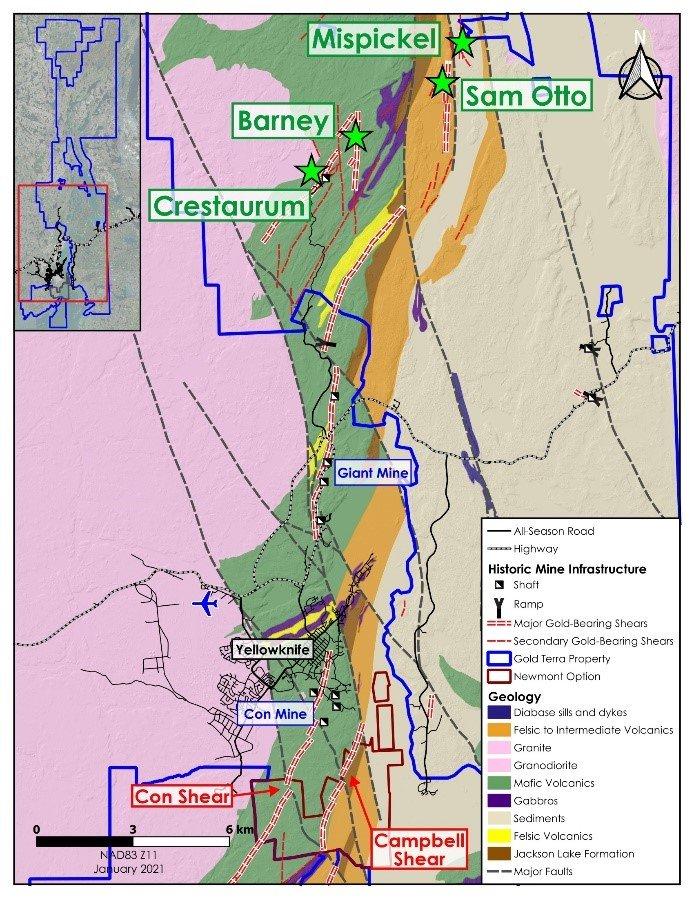

The 2021 inferred mineral resource estimate illustrates the growing value of the Yellowknife camp and has opened-up several exploration opportunities to increase mineral resources on the Northbelt property. The Yellowknife camp was developed along the Campbell Shear, the main structure in the belt and host to the largest gold plumbing system of the area on which both the Giant (8 million ounces produced) and Con Mines (6.1 million ounces produced) were developed. Similar to most Archean gold camps in Canada and in the world, numerous gold deposits within the YCG Project may re-establish Yellowknife as a premier mining camp in close proximity to the City of Yellowknife where all the infrastructure is already in place, making the development of these deposits much easier. Specific targets with the potential to increase mineral resources include:

- The untested depth extension on both the Sam Otto Main and the Sam Otto South deposits. Both Sam Otto deposits are open to the North and at depth and it is recommended to follow up with a drill program at depth below the current deposit outline or below the 250 metre vertical depth.

- Selective closer spaced drilling at the Crestaurum deposit can potentially increase mineral resources below the 300 metre depth. SGS Geological Services constrained the Crestaurum deposit to above 300 vertical metres as 2020 drilling below this depth and down to 500 vertical metres that successfully intersected the gold structure was deemed too widely spaced to be included in the inferred mineral resource.

- In addition, 2020 drilling on the Crestaurum deposit revealed an untested three-kilometre strike length of this gold bearing structure to the south of the current resource, possibly extending to the Ranney Hill high-grade showings on surface and effectively tripling the strike length of this gold bearing structure.

- A review of the structural controls on the Mispickel and Barney deposits during the 2021 mineral resource estimation revealed potential for increasing these higher grade zones both along the plunge of the known high-grade zones, and for discovery of new high-grade lodes over a potential three-kilometre mineralized structure at Mispickel.

Estimation Methods

The mineral resource estimate for 2021 includes the four gold deposits previously reported in the initial mineral resource estimate prepared in accordance with NI 43-101 in November 2019: Sam Otto, Crestaurum, Barney and Mispickel, which are all within a three-kilometre radius. The initial mineral resource estimate incorporated the results from the 463 drill holes totaling 90,751 metres used in the 2019 mineral resource estimate, and for this update an additional 59 holes totaling 17,540 metres are incorporated from drilling completed in 2020 on the Crestaurum and Sam Otto deposits. In general, the drilling is variably spaced reflecting different mineralization styles and ranges from 25 to 100 metres apart.

The mineral resource estimate was prepared by Dr. Allan Armitage, P.Geo., from SGS Geological Services (“SGS”). SGS used Geovia Gems software to construct mineralized wireframes for each zone and then interpolated tonnage and grade into block models constrained by the mineralized wireframes and used inverse distance squared (ID2) or inverse distance cubed (ID3) interpolation. Appropriate interpolation parameters were generated for each deposit based on the mineralization style and geometry.

The pit shells were created using Whittle pit optimization software and applying the following optimization parameters: US$1,500 gold price; US$2.20/tonne for mining cost; US$16.00/tonne for processing and G&A costs; 90% metallurgical recovery; 5% dilution (external); 5% mining loss; and 60° pit slopes (the deposits occur in areas of extensive outcrop with negligible overburden).

A review by SGS engineers of the size, geometry and continuity of mineralization was conducted to determine underground mineablility of the deposits. On the Sam Otto deposit it was concluded that bulk underground mining below the pit shells was possible, and a cut-off grade of 1.4 g/t Au is used to define underground inferred mineral resources on this deposit using an underground mining cost of US$44.00/tonne and US$16.00/tonne processing and G&A costs. Similarly, bulk underground mining at the Barney deposit uses a cut-off grade of 2.0 g/t Au and a mining cost of US$68/tonne with US$16.00/tonne processing and G&A costs. Crestaurum is considered a high-grade selective mining deposit and a 2.5 g/t cut-off grade is used with a mining cost of US$79.00/tonne with US$16.00/tonne processing and G&A costs.

The mineral resource estimates are summarized in the following table. A supporting technical report prepared in accordance with NI 43-101 will be filed on SEDAR at www.sedar.com within 45 days of this release.

- The classification of the current mineral resource estimate into an inferred mineral resource is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves

- All figures are rounded to reflect the relative accuracy of the estimate.

- All mineral resources are presented undiluted and in situ and are considered to have reasonable prospects for eventual economic extraction.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. An inferred mineral resource has a lower level of confidence than that applying to a measured mineral resource and an indicated mineral resource. The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred mineral resources as a measured mineral resource or an indicated mineral resource and it is uncertain if further exploration will result in upgrading the inferred mineral resource to a measured mineral resource or an indicated mineral resource.

- It is envisioned that parts of the Sam Otto/Dave’s Pond, Mispickel and Crestaurum deposits may be mined using open pit mining methods. Open pit mineral resources are reported at a cut-off grade of 0.4 g/t Au within a conceptual pit shell.

- It is envisioned that parts of the Sam Otto/Dave’s Pond and Barney deposits may be mined using lower cost underground bulk mining methods whereas parts of the Crestaurum deposit may be mined by underground selective narrow vein methods. A selected cut-off grade of 1.4 g/t Au is used to determine the underground mineral resource for the Sam Otto/Dave’s Pond deposit, 2.0 g/t Au for the Barney deposit (assuming it can be accessed underground from the Crestaurum deposit), and 2.5 g/t for the Crestaurum Deposit.

- High-grade capping was done on 1 m composite data. Capping values of 55 g/t Au were applied to Crestaurum and 60 g/t Au for Mispickel.

- Specific gravity values were determined based on physical specific gravity test work from each deposit: Crestaurum at 2.85; Barney at 3.00; Sam Otto and Mispickel at 2.80.

- Cut-off grades are based on a gold price of US$1,500 per ounce, a gold recovery of 90%, processing cost of US$16.00 per tonne milled, and variable mining costs including US$2.00 for open pit and US$44.00 to US$79.00 for underground.

- The results from the pit optimization are used solely for the purpose of testing the “reasonable prospects for economic extraction” by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Property. The results are used as a guide to assist in the preparation of a mineral resource statement and to select an appropriate resource reporting cut-off grade.

- The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Significant increases in the in situ mineral inventory from the 2019 mineral resource estimates was achieved by the 2020 drilling at Sam Otto and Crestaurum, which increased the strike and dip of both these deposits.

Increases in reported total inferred mineral resources in 2021 also reflects the change in gold price from $1,300/oz Au in the 2019 resource estimate to $1,500/oz Au in the 2021 mineral resource estimate. Other economic parameters for generating cut-off grades remained the same as in 2019. The increase in gold price resulted in a drop in open pit cut-off grade from 0.50 g/t Au in 2019 to 0.40 g/t Au in 2021.

Additionally, changes in underground mining methods and higher gold price resulted in a lowering of underground mining cut-off grades from 3.0 g/t Au in the 2019 mineral resource estimate to 2.5, 2.0 and 1.4 g/t Au for Crestaurum, Barney and Sam Otto respectively.

It should be noted that for the Crestaurum deposit, the reported inferred mineral resource estimate was only extended to 300m vertical depth. Gold Terra drilled several holes below this depth in 2020 that intersected the Crestaurum mineralized structure, but it was decided by SGS that the spacing between these deep holes, and their distance from the shallower drilling on Crestaurum precluded their inclusion in the 2021 mineral resource estimate.

Technical Information and Quality Control Procedures

The technical information contained in this news release has been verified, reviewed and approved by Dr. Allan Armitage, P.Geo. from SGS, who is an independent Qualified Person under NI 43-101. The information contained in this news release was also verified, reviewed and approved by Joe Campbell, P. Geo., Chief Operating Officer for Gold Terra and a Qualified Person under NI 43-101.

Gold Terra’s drilling programs are monitored through the implementation of a quality assurance and quality control (QA/QC) program. The drill core (NQ size) is logged and sample intervals for assay are selected by Gold Terra’s geologists. In general, the sampling intervals vary from half a metre to one metre in length depending on the geology and mineralization observed. The drill core samples are cut by diamond saw at Gold Terra ’s core facilities in Yellowknife. Half of the core sample is left in the core box and stored in a dedicated core storage facility in Yellowknife. The other half-core samples are transported in securely sealed bags by Gold Terra personnel to ALS Limited (“ALS”) preparation laboratory in Yellowknife. After sample preparation, samples are shipped to ALS Vancouver facility for gold and a complete digestion four acid ICP analysis for 33 elements. Gold assays of >3 g/t are re-assayed on a 30 gram split by fire assay with a gravimetric finish. ALS is a certified and accredited laboratory service operating to ISO 17025 standards. ALS routinely inserts certified gold standards, blanks and pulp duplicates, and results of all QC samples are reported. Gold Terra inserts certified standards and blanks into the sample stream as a check on laboratory QC.

In addition to traditional assay methods, Gold Terra also carries out a variety of spectrometry tests on selected core and rock samples to determine the associated mineral characterization and the gold deportment within the mineralized zones.

About Gold Terra’s Yellowknife City Gold Project

The YCG Project encompasses 800 sq. km of contiguous land immediately north, south and east of the City of Yellowknife in the Northwest Territories. Through a series of acquisitions, Gold Terra controls one of the six major high-grade gold camps in Canada. Being within 10 kilometres of the City of Yellowknife, the YCG is close to vital infrastructure, including all-season roads, air transportation, service providers, hydro-electric power and skilled tradespeople.

The YCG Project lies on the prolific Yellowknife greenstone belt, covering nearly 70 kilometres of strike length along the main mineralized shear system that host the former-producing high-grade Con and Giant gold mines. The Company’s exploration programs have successfully identified significant zones of gold mineralization and multiple targets that remain to be tested which reinforces the Company’s objective of re-establishing Yellowknife as one of the premier gold mining districts in Canada.

Visit our website at www.goldterracorp.com.

For more information, please contact:

David Suda, President and CEO

Phone: 604-928-3101 | Toll-Free: 1-855-737-2684

dsuda@goldterracorp.com

Mara Strazdins, Manager of Investor Relations

Phone: 1-778-897-1590 | 604-689-1749 ext 102

Strazdins@goldterracorp.com

In Europa:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

Certain statements made and information contained in this news release constitute "forward-looking information" within the meaning of applicable securities legislation ("forward-looking information"). Generally, this forward-looking information can, but not always, be identified by use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events, conditions or results "will", "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotations thereof.

All statements other than statements of historical fact may be forward-looking information. Forward-looking information is necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information. In particular, this news release contains forward-looking information regarding the future plans for drilling and exploration at the YCG Project; current drilling at the YCG Project; the ability of the Company to expand the mineralized system at the YCG Project; forward looking assumptions used relating to the mineral resources estimates; statements related to the growing value of the Yellowknife camp; future development at specific targets; the possibility of bulk underground mining below the pit shells at the Sam Otto deposit; statements with respect to mineral reserves and mineral resource estimates (including proposals for the potential growth, extension, update and/or upgrade thereof, the anticipated timing thereof and any future economic benefits which may be derived therefrom; the timing for filing an updated mineral resource estimate; and the Company’s objective of re-establishing Yellowknife as one of the premier gold mining districts in Canada.

There can be no assurance that such statements will prove to be accurate, as the Company’s actual results and future events could differ materially from those anticipated in this forward-looking information as a result of the factors discussed in the "Risk Factors" section in the Company’s most recent MD&A and annual information form available under the Company’s profile at www.sedar.com.

Although the Company has attempted to identify important factors that would cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. The forward-looking information contained in this news release is based on information available to the Company as of the date of this news release. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. All of the forward-looking information contained in this news release is qualified by these cautionary statements. Readers are cautioned not to place undue reliance on forward-looking information due to the inherent uncertainty thereof. Except as required under applicable securities legislation and regulations applicable to the Company, the Company does not intend, and does not assume any obligation, to update this forward-looking information.

CAUTIONARY NOTE TO UNITED STATES INVESTORS CONCERNING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES

The Company prepares its disclosure in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Terms relating to Mineral Resources in this news release are defined in accordance with NI 43-101 under the guidelines set out in CIM Standards.

The United States Securities and Exchange Commission (the "SEC") has adopted amendments effective February 25, 2019 (the "SEC Modernization Rules") to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the United States Securities Exchange Act of 1934. The SEC Modernization Rules have replaced SEC Industry Guide 7, which will be rescinded following a transition period and after the required compliance date of the SEC Modernization Rules.

As a result of the adoption of the SEC Modernization Rules, the SEC will now recognize estimates of "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources", which are defined in substantially similar terms to the corresponding CIM Standards. In addition, the SEC has amended its definitions of "Proven Mineral Reserves" and "Probable Mineral Reserves" to be substantially similar to the corresponding CIM Standards.

United States investors are cautioned that while the foregoing terms are "substantially similar" to corresponding definitions under the CIM Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any Mineral Resources that the Company may report as "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources" under NI 43-101 would be the same had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

United States investors are also cautioned that while the SEC will now recognize "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources", investors should not to assume that any part or all of the mineral deposits in these categories would ever be converted into a higher category of Mineral Resources or into Mineral Reserves. Mineralization described by these terms has a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Accordingly, investors are cautioned not to assume that any "Measured Mineral Resources", "Indicated Mineral Resources", or "Inferred Mineral Resources" that the Company reports are or will be economically or legally mineable.

Further, "Inferred Resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the Inferred Resources exist. In accordance with Canadian securities laws, estimates of "Inferred Mineral Resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

In addition, disclosure of "contained ounces" is permitted disclosure under Canadian regulations; however, the SEC has historically only permitted issuers to report mineralization as in place tonnage and grade without reference to unit measures.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()