Highlights

- Increased Proven and Probable (“P&P”) Gold Reserves by 0.75 Moz, net of depletion, or 14% year-on-year to 143 Mt at 1.32 g/t Au for 6.06 Moz.

- Declared Initial P&P Gold Reserve at Martha Underground of 4.5 Mt at 4.33 g/t Au for 0.62 Moz in conjunction with the Feasibility Study.

- P&P Reserves of 40.8 Mt at 0.99 g/t Au for 1.3 Moz at Macraes, including 2.6 Mt at 2.10 g/t Au for 0.16 Moz at Golden Point Underground expected to deliver first production in the fourth quarter of 2021.

- Increased total Measured and Indicated (“M&I”) Gold Resources by 0.66 Moz, net of depletion, or 7% year-on-year to 243 Mt at 1.28 g/t Au for 10.0 Moz.

- Declared Inferred Gold Resources of 75 Mt at 1.8 g/t Au for 4.4 Moz, net of depletion, an increase of 2% year-on-year or 0.1 Moz.

Michael Holmes, President and CEO of OceanaGold said, ”We are pleased to declare gold Reserves of 6.06 Moz and 10.0 Moz of Measured and Indicated Resources, a 0.75 Moz increase in reserves net of depletion, reflecting our commitment to creating value through exploration, a quality asset base and consistent performance.”

“At the Waihi gold mine in New Zealand the Feasibility Study has defined an initial P&P Reserve of 0.62 Moz of gold for the Martha Underground Project, confirming our confidence in delivery of the asset and our vision for the Waihi District. Just North of Waihi, drilling is ongoing at the Wharekirauponga (“WKP”) Prospect to convert resources, test extensions to known mineralised veins and support the Pre-Feasibility study targeted for release in late 2021.”

“On the South Island of New Zealand, the Macraes life of mine has been extended to 2028 and the Golden Point Underground is on-track for first production later this year with an initial Reserve of 0.16 Moz of gold.”

“At the Haile gold mine in the United States of America, 2.43 Moz of gold Reserve is contained within the optimised open pit while an important underground Reserve of 0.42 Moz is growing through conversion of a large resource base totalling 0.53 Moz of Indicated Resource and 0.9 Moz of Inferred Resource. Exploration continues to focus on both continued resource conversion as well as underground discovery with the objective to match production from the new underground mines with the open pit operations and ultimately extend gold production past the current life of mine of 2032.”

Reserves

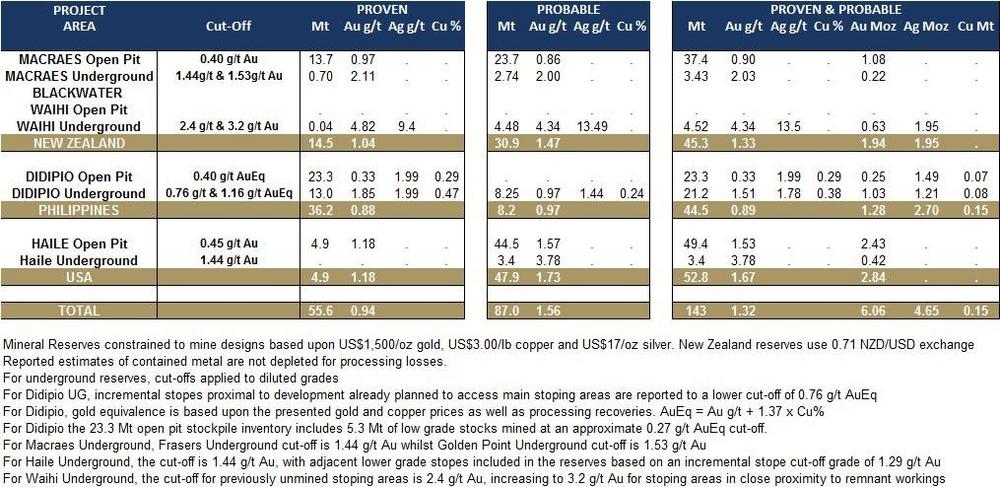

As at 31 December 2020, the Company’s P&P Reserves stood at 143 Mt at 1.32 g/t Au for 6.06 Moz of gold, including 4.65 Moz of silver and 0.15 Mt of copper, representing a 0.75 Moz increase in gold Reserves year-on-year net of depletion (Table 1). The 14% year-on-year net increase is attributable to model updates of 1.00 Moz, reflecting the commitment to exploration drilling and organic growth as demonstrated by first-time reporting of 4.5 Mt at 4.33 g/t Au for 0.62 Moz Reserves at Martha Underground and 2.6 Mt at 2.10 g/t Au for 0.16 Moz at Golden Point Underground in New Zealand. Economic factors represent a minor contribution of 0.10 Moz to the net increase in P&P Reserves (Figure 1).

Resources

As at 31 December 2020, the Company’s M&I Resources stood at 243 Mt at 1.28 g/t Au for 10.0 Moz of gold, 14.0 Moz of silver and 0.17 Mt of copper (Table 2). On a consolidated basis, the Company increased M&I Resources by 0.66 Moz, year-on-year net of depletion, mainly due to the successful drilling-related resource upgrades of 0.65 Moz, predominantly at New Zealand operations. Changes in economic factors also had a positive impact of approximately 0.46 Moz (Figure 2).

Adjustments to M&I Resources include a net reduction of 0.18 Moz in 2020 that reflects a reduction at Macraes partially off-set by an addition at Waihi associated with operational changes, including:

- Macraes: reductions due to a proportion of Round Hill Open-pit resources that were excised immediate to the new Golden Point Underground and removal of non-economic Frasers Underground resources, and

- Waihi: additions due to a proportion of Martha Underground resource now reported within the Martha Open-pit.

Consolidated Inferred Resources, year-on-year, increased by 0.1 Moz to 4.4 Moz of gold, while silver and copper Inferred Resources also increased to 6.3 Moz and 0.04 Mt, respectively (Table 3, Figure 3).

Pricing and Sensitivities

The Company used gold prices of $1,500 per ounce and $1,700 per ounce for estimating P&P Reserves and Mineral Resources, respectively, and a silver price of $17.00 per ounce for estimating both Reserves and Resources. The metal price assumptions used are aligned with the three-year trailing average gold and silver price actuals of $1,477 per ounce and $17.49 per ounce, respectively (2018 to 2020 year-end). The Company believes the three-year trailing average metals pricing most appropriately reflect the economic conditions at the time of mineral reserve estimation. The Company estimates a $1,300 gold price, a $200/oz decrease as compared to the current three-year trailing average utilised, would result in a reduction of approximately 4% in P&P Reserves.

New Zealand

Waihi

Reserves at Waihi stood at 0.63 Moz gold after reclassification of the Martha Open Pit reserve of 0.08 Moz. This 0.52 Moz increase year-on-year is due to the newly declared Martha Underground reserve of 4.5 Mt at 4.33 g/t Au for 0.62 Moz (Figure 4).

The Waihi M&I Resources stood at 1.83 Moz gold, representing a year-on-year increase of 0.39 Moz due primarily to the conversion of Inferred Resources at Martha Underground and model updates (see 16 February 2021 press release) and the addition of open pit resources at Martha and Gladstone (Figure 5).

In 2021, the Company expects to drill 27,000 metres at Martha Underground with a focus on resource conversion (20,000 metres) and resource extension (7,000 metres). The Company has revised the Exploration Target for Martha Underground which now stands at 5 to 7 million tonnes with a grade of 4.0 to 5.0 g/t gold. It is important to note that the Exploration Target is exclusive of the reported Mineral Resources and relates to the portion of the deposit that has not yet been adequately drill tested (see cautionary statement below).

Cautionary Statement: The Exploration Target is based on the assessment of surface and underground drill data collected by the Company in addition to the significant amount of historical and archived geological and mine data from over a century of mining activity at Waihi. The Exploration Target is conceptual in nature and insufficient exploration has been undertaken in the areas that the Exploration Target relates to estimate a Mineral Resource. It is uncertain if further exploration will result in the estimation of a Mineral Resource.

The Waihi Inferred Resources stood at 1.4 Moz gold. This represents a 0.1 Moz increase due to the expansion of the Martha Open Pit resource (Figure 6).

At the WKP project located 10 kilometres north of the existing Waihi facilities, the Company reported an Indicated Resource of 1.0 Mt at 13.4 g/t Au and 25.5 g/t Ag for 0.42 Moz of gold and 0.80 Moz of silver, in addition to an Inferred Resource of 1.9 Mt at 12 g/t Au and 20 g/t Ag for 0.72 Moz of gold and 1.23 Moz of silver, as reported in the 2019 Resource and Reserve Statement. These estimates remain unchanged in the current R&R statement. The Company intends to incorporate 2020 (4,000 metres) and 2021 drilling (estimated 10,500 metres) into an updated resource model supporting the completion of a Pre-Feasibility study by 2021 year-end.

Macraes

The P&P Reserves for Macraes stood at 1.30 Moz gold with 1.08 Moz in the open pits and 0.22 Moz of gold in the Frasers and Golden Point underground mines (Figure 7). Year-on-year drilling-related reserve growth has increased Reserves 0.20 Moz net of 2020 depletion due mainly to the addition of 0.17 Moz at Golden Point Underground and reserve growth at Frasers Open Pit.

The Macraes M&I Resources stood at 3.60 Moz of gold, including 0.56 Moz for the Frasers Underground and Golden Point Underground mines (Figure 8). The year-on-year net increase in M&I Resources of 0.15 Moz is attributable to model updates of 0.40 Moz, reflecting successful exploration drill programs as demonstrated by first-time reporting of the Golden Point Underground resource (10 September 2020), open pit resource growth and to a lesser extent, 0.14 Moz reflected in economic factors. Adjustments reflect Round Hill Open Pit reductions due to a loss of resources associated with the allocation to Golden Point Underground and removal of non-economic Frasers Underground resources (see Figure 8).

Macraes Inferred Resources stood at 0.8 Moz of gold, a decrease from the previous year, due mainly to the conversion of Inferred Resources to the Indicated category and, to a lesser extent, depletion (Figure 9).

Reefton

Resources for the Blackwater Project remain on the Company’s inventory and are unchanged from the 31 December 2019 reported resources.

United States of America

Haile

P&P Reserves totalled 2.84 Moz of gold including 0.42 Moz in the Haile Underground (Figure 10). Depletion has largely been offset by resource conversion and changes in economic factors.

Total Haile M&I Resources stood at 3.18 Moz of gold, including 0.53 Moz for the Haile Underground. Depletion during 2020 has been offset by economic factors (Figure 11).

Year-on-year, Inferred Resources remain essentially unchanged with resource update reductions being offset by changes in economic factors (Figure 12). Haile growth focuses on resource conversion drilling and exploration of underground targets.

Philippines

Didipio

Didipio P&P Reserves stood at 1.28 Moz of gold, 2.7 Moz of silver and 0.15 Mt of copper, a small year-on-year increase (Figure 13). The increase is largely due to a lowered reserve reporting cut-off grade (0.76 g/t AuEq cut-off) in areas adjacent to development planned to access higher grade stoping areas (1.16 g/t AuEq cut-off). The reserves include 23 Mt of low and medium grade open pit stockpiles, 5.3 Mt of which are based upon a 0.27 g/t AuEq cut-off, the remainder based on an approximate 0.4 g/t AuEq cut-off. The Company continues to work with the Philippine National Government on renewal of Didipio’s operating agreement (the Financial or Technical Assistance Agreement or “FTAA”), and the mine remains in a state of operational standby. As the renewal discussion is continuing to progress and detailed planning and consultation is underway for recommencement of operation, the Company maintains reporting of Didipio as a Mineral Reserve.

Didipio M&I Resources stood at 1.43 Moz of gold, 2.93 Moz of silver and 0.17 Mt of copper, a small year-on-year increase of 0.05 Moz due to lowered resource reporting cut-off grade (0.67 g/t AuEq cut-off at increased gold price of $1,700 per ounce) (Figure 14). The resources include 23 Mt of low and medium grade open pit stockpiles.

Inferred Resources stood at 0.4 Moz of gold, 0.6 Moz of silver and 0.04 Mt of copper, a 0.1 Moz year-on-year increase due to lowered cut-off grade (Figure 15).

Other

OceanaGold’s interest in the Sam’s Creek project in New Zealand remains unchanged at 20%.

As part of the requirements under the listing rules of the Australian Stock Exchange, the Company has filed a separate document containing the material summaries and JORC Table 1 information related to the resource and reserves. These can be found at https://oceanagold.com/investor-centre/tsx-asx-filings/.

Martha Underground Feasibility Study

The Waihi District – Martha Underground Feasibility Study, 31 March 2021, provides an update of information contained in the Waihi District PEA, 30 August 2020 for all Waihi geological resources and for mining evaluations for Martha Underground. The Feasibility Study includes an initial Reserve at Martha Underground of 4.5 Mt at 4.33 g/t Au for 0.62 Moz. The Feasibility Study also includes reporting of an additional 0.26 Moz of Indicated Resource at Martha Underground that has for the most part been converted from Inferred Resource (see comparison of the resources in Tables 5 and 6 below). Correspondingly, this conversion has resulted in a 0.20 Moz decrease in Inferred Resources.

About OceanaGold

OceanaGold is a multinational gold producer committed to the highest standards of technical, environmental, and social performance. For 30 years, we have been contributing to excellence in our industry by delivering sustainable environmental and social outcomes for our communities, and strong returns for our shareholders. Our global exploration, development, and operating experience has created an industry-leading pipeline of organic growth opportunities and a portfolio of established operating assets including Didipio Mine in the Philippines; Macraes and Waihi operations in New Zealand; and Haile Gold Mine in the United States of America.

Technical Disclosure

All Mineral Reserves and Mineral Resources were calculated as at December 31, 2020 and have been calculated and prepared in accordance with the standards set out in the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves dated December 2012 (the “JORC Code”) and in accordance with National Instrument 43-101 of the Canadian Securities Administrators (“NI 43-101”). The JORC Code is the accepted reporting standard for the Australian Stock Exchange Limited (“ASX”).

The definitions of Ore Reserves and Mineral Resources as set forth in the JORC Code have been reconciled to the definitions set forth in the CIM Definition Standards. If the Mineral Reserves and Mineral Resources were estimated in accordance with the definitions in the JORC Code, there would be no substantive difference in such Mineral Reserves and Mineral Resources.

Any updates of Mineral Resources for Macraes and Blackwater have been verified and approved by J. Moore while the updates of Mineral Reserves for Macraes open pits have been verified and approved by, or are based on information prepared by, or under the supervision of, P Doelman. The Mineral Reserves for Macraes underground have been verified and approved by or are based upon information prepared by, or under the supervision of, T. Cooney.

Any updates of Mineral Resources for Waihi have been verified and approved by, or are based on information prepared by, or under the supervision of, P. Church. The Mineral Reserves for Waihi have been verified and approved by, or are based on information prepared by, or under the supervision of, T. Maton for open pit and D. Townsend for underground.

The updates of Mineral Resources for Haile open pit and underground have been verified and approved by, or are based on information prepared by, or under the supervision of, J. G. Moore. The updates of Mineral Reserves for Haile open pits have been verified and approved by, or are based on information prepared by, or under the supervision of, G. Hollett and the Mineral Reserves for Haile underground have been verified and approved by or are based upon information prepared by, or under the supervision J. Poeck.

The Mineral Resources for Didipio have been verified and approved by, or are based on information prepared by, or under the supervision of, J. Moore while the Mineral Reserves for Didipio underground have been verified and approved by or are based upon information prepared by, or under the supervision P. Jones.

Messrs, Church, Doelman, Maton and Townsend are full-time employees of the Company’s subsidiary, Oceana Gold (New Zealand) Limited. Messrs Cooney, Hollett, Jones, and Moore are full-time employees of the Company’s subsidiary, OceanaGold Management Pty Limited. Both OceanaGold (Philippines) Inc. and Haile Gold Mine Inc. are subsidiaries of the Company.

G. Hollett is a Professional Engineer (P.Eng) registered with Engineers and Geoscientists of British Columbia (EGBC). Messrs Church, Cooney, Doelman, Jones, Maton, Moore and Townsend are Members and Chartered Professionals with the Australasian Institute of Mining. J. Poeck is a full-time employee of SRK Consulting and a registered member of the Society for Mining, Metallurgy and Exploration (SME) and a QP member of Mining and Metallurgical Society of America (MMSA).

All such persons are “qualified persons” for the purposes of NI 43-101 and have sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity which they are undertaking to qualify as a “competent person” as defined in the JORC Code.

J. Poeck and Messrs Church, Cooney, Doelman, Hollett, Jones, Maton, Moore, and Townsend consent to inclusion in this public release of the matters based on their information in the form and context in which it appears. The estimates of Mineral Resources and Mineral Reserves contained in this public release are based on, and fairly represent, information and supporting documentation prepared by the named qualified and competent persons in the form and context in which it appears.

The estimates of Mineral Resources and Reserves contained in this public release are based on, and fairly represent, information and supporting documentation prepared by the named qualified and competent persons in the form and context in which it appears.

For further scientific and technical information supporting the disclosure in this media release (including disclosure regarding Mineral Resources and Mineral Reserves, data verification, key assumptions, parameters, and methods used to estimate the Mineral Resources and Mineral Reserves, and risk and other factors) relating to the Didipio Gold-Copper Mine, the Macraes Mine, the Haile Gold Mine the Waihi Gold Mine and the Blackwater project, please refer to the following NI 43-101 compliant technical reports and the Blackwater Preliminary Economic Assessment released on 21 October 2014 available at www.sedar.com under the Company’s name

“NI 43-101 Technical Report, Macraes Gold Mine, Otago, New Zealand” dated October 14, 2020, prepared by D. Carr, Chief Metallurgist and T. Cooney, General Manager of Studies, both of OceanaGold Management Pty Limited and P. Doelman, Tech Services and Project Manager, S. Doyle, Principal Resource Geologist and P Edwards, Senior Project Geologist, each of OceanaGold (New Zealand) Limited”;

a) “Technical Report for the Reefton Project located in the Province of Westland, New Zealand” dated May 24, 2013, prepared by K. Madambi, Technical Services Manager of Oceana Gold (New Zealand) Limited up until January 2018 and J. G. Moore, Chief Geologist, of Oceana Gold (New Zealand) Limited (the “Reefton Technical Report”);

b) “Technical Report for the Didipio Gold / Copper Operation Luzon Island” dated October 29, 2014, prepared by Simon Griffiths, General Manager of Studies, of Oceana Gold (New Zealand) Limited up until March 2017, J. G. Moore, Chief Geologist, of Oceana Gold (New Zealand) Limited, and Michael Holmes, Chief Operating Officer of OceanaGold Corporation (the “Didipio Technical Report”);

c) Waihi District Study – Martha Underground Feasibility Study NI 43-101 Technical Report” dated March 31, 2021, prepared by T. Maton, Study Manager and P. Church, Principal Resource Development Geologist, both of Oceana Gold (New Zealand) Limited, and D. Carr, Chief Metallurgist, of OceanaGold Management Pty Limited (the “Waihi Technical Report”); and

d) “NI 43-101 Technical Report Haile Gold Mine Lancaster County, South Carolina” dated September 30, 2020, prepared by David Carr, Tom Cooney and Jonathan Moore of OceanaGold Management Pty Limited, John Jory and Michael Kirby of Haile Gold Mine, Joanna Poeck, Matt Sullivan, Dave Bird, Fernando Rodrigues, Brian S. Prosser and John Tinucci of SRK Consulting, Jay Newton Janney-Moore and William Lucas Kingston of Newfields and Larry Standridge of Call and Nicholas (the “Haile Technical Report”).

Cautionary Note Regarding Mineral Resources and Mineral Reserves

The Company’s disclosure of Mineral Reserve and Mineral Resource information is governed by NI 43-101 under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as may be amended from time to time by the CIM (“CIM Standards”). The disclosure of Mineral Reserve and Mineral Resource information for properties held by the Company is based on the reporting requirements of the JORC Code. CIM definitions of the terms “Mineral Reserve”, “Proven Mineral Reserve”, “Probable Mineral Reserve”, “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource”, are substantially similar to the JORC Code corresponding definitions of the terms “Ore Reserve”, “Proved Ore Reserve”, “Probable Ore Reserve”, “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource”, respectively. Estimates of Mineral Resources and Mineral Reserves prepared in accordance with the JORC Code would not be materially different if prepared in accordance with the CIM definitions applicable under NI 43-101.

There can be no assurance that those portions of such Mineral Resources that are not Mineral Reserves will ultimately be converted into Mineral Reserves. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. All Mineral Reserves are within the Mineral Resource.

Cautionary Statement for Public Release

Certain information contained in this public release may be deemed “forward-looking” within the meaning of applicable securities laws. Forward-looking statements and information relate to future performance and reflect the Company’s expectations regarding the generation of free cash flow, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of OceanaGold Corporation and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking statements and information. They include, among others, the accuracy of Mineral Reserve and resource estimates and related assumptions, inherent operating risks and those risk factors identified in the Company’s most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR at www.sedar.com under the Company’s name. There are no assurances the Company can fulfil forward-looking statements and information. Such forward-looking statements and information are only predictions based on current information available to management as of the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company’s control. Although the Company believes that any forward-looking statements and information contained in this press release is based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements and information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws. The information contained in this release is not investment or financial product advice.

NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +1 (720) 484-1147

E-Mail: IR@oceanagold.com

Media Relations

Telefon: +61 (407) 783-270

E-Mail: info@oceanagold.com

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()