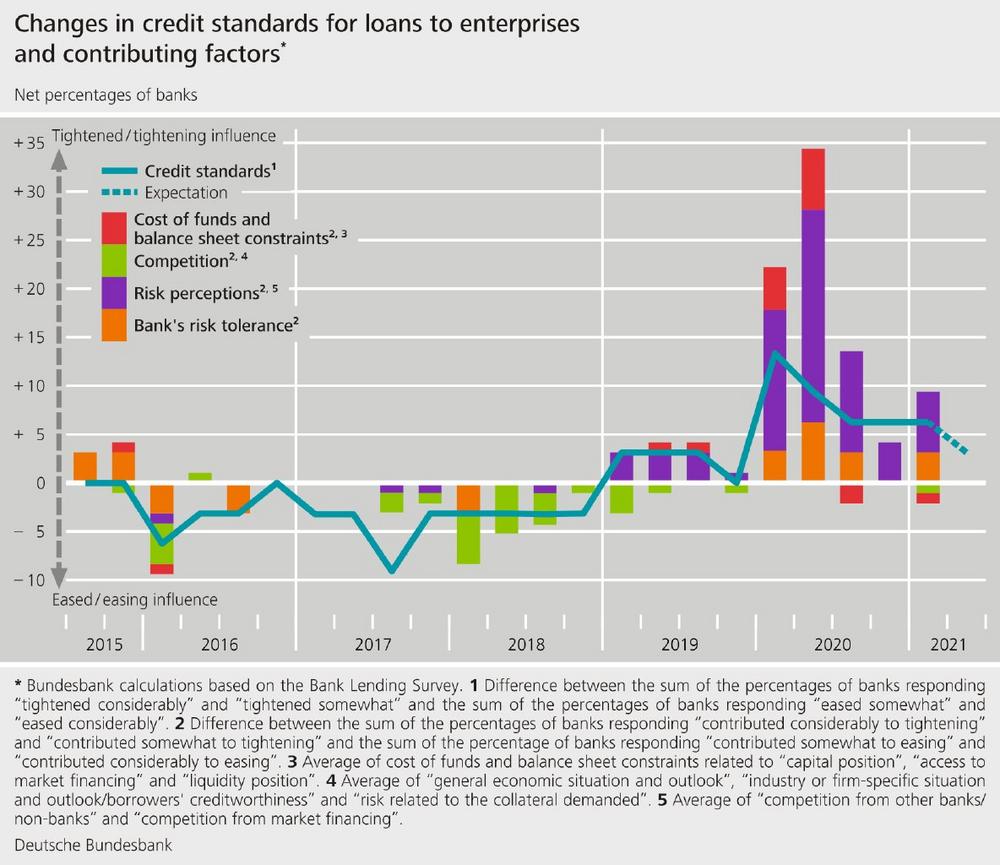

– The German banks responding to the Bank Lending Survey (BLS) once again tightened their credit standards for loans to enterprises somewhat in the first quarter of 2021. Standards remained unchanged for loans to households for house purchase, and they were eased marginally for consumer credit and other lending to households.

– Demand increased again for loans to enterprises, remained constant for loans for house purchase, and saw a stronger decline for consumer credit and other lending to households.

– The interest rate-reducing impact of the Eurosystem’s expanded asset purchase programme (APP) and the pandemic emergency purchase programme (PEPP) impacted negatively on bank profitability. Taken in isolation, the negative interest rate on the deposit facility was another factor that continued to contribute negatively to banks’ net interest income.

– Bank demand remained lively for the third series of targeted longer-term refinancing operations (TLTRO-III) in December 2020 and March 2021. The funds taken up were used primarily for granting loans and as a substitute for TLTRO-II funding and maturing debt securities.

The Bank Lending Survey (BLS) covers three loan categories: loans to enterprises, loans to households for house purchase, and consumer credit and other lending to households. The surveyed banks once again tightened their credit standards (i.e. their internal guidelines or criteria for granting loans) on balance for loans to enterprises (the net percentage of banks which tightened their standards was +6%, as in the previous quarter). A heightened assessment of credit risk was the main reason banks cited for this. Credit standards for loans to households for house purchase remained unchanged (net percentage of +0%, after +0% in the previous quarter). There was a marginal easing of credit standards for consumer credit and other lending to households (net percentage of -3%, after +0% in the previous quarter). For the next three months, banks are not planning to make any notable net changes to their credit standards for loans to enterprises and for house purchase. They intend to ease their standards for consumer credit and other lending to households on balance. Banks left their overall terms and conditions (i.e. their actual terms and conditions agreed in the loan contract) unchanged in all surveyed loan categories. They did, however, widen their margins somewhat on riskier loans to enterprises in particular and on housing loans.

Demand for loans to enterprises rose further, but lagged well short of the robust increase registered in the first three quarters of 2020. Banks mainly attributed this uptick in demand to financing needed for debt refinancing/restructuring and renegotiation and for inventories and working capital. The loan rejection rate remained relatively high. Enterprises from sectors hit particularly hard by the crisis, such as accommodation and food service activities and the retail trade, had a restricted access to credit. Banks reported that demand remained constant on the quarter for loans for house purchase and saw a stronger decline for consumer credit and other lending to households. Over the next three months, banks are expecting to see demand grow for loans to enterprises and for consumer credit and other lending to households and decline for loans to households for house purchase.

The April survey round contained ad hoc questions on banks’ funding conditions and on the impact of the Eurosystem’s purchase programmes (APP and PEPP). Other ad hoc questions addressed the effects of the negative interest rate on the Eurosystem deposit facility and the two-tier system for remunerating excess liquidity holdings. The survey additionally contained questions on the Eurosystem’s third series of targeted longer-term refinancing operations (TLTRO-III).

Against the backdrop of conditions in financial markets, German banks reported that their funding situation was largely unchanged compared with the previous quarter. Over the past six months, the Eurosystem’s purchase programmes (APP and PEPP) have helped improve banks’ liquidity position and their market financing terms, but they were still impacting negatively on bank profitability through net interest income. Survey respondents indicated that the purchase programmes had not contributed to credit growth over the last six months. The negative deposit facility rate was another factor that continued to contribute negatively to banks’ net interest income. Taken in isolation, it depressed lending and deposit rates and pushed up non-interest rate charges on deposits. Banks singled out housing loans as the only category in which the negative interest rate increased volumes to a notable degree. The two-tier system for remunerating excess liquidity holdings tempered the negative impact on profitability, however.

Twelve banks from the German sample took part in the TLTRO-III operation in December 2020, while 17 participated in the March 2021 operation, mainly on account of the attractive conditions. Like earlier TLTRO-III operations, these two operations thus once again met with lively demand in the banking community. Banks reported using the uptake of funds primarily for granting loans and as a substitute for TLTRO-II funding and maturing debt securities. They stated that they would also be participating in future operations mainly because of the TLTRO-III operations’ attractive conditions. The TLTRO-III operations had barely any impact on banks’ lending policies.

The Bank Lending Survey, which is conducted four times a year, took place between 11 March and 26 March 2021. In Germany, 34 banks took part in the survey. The response rate was 100%.

Deutsche Bundesbank

Wilhelm-Epstein-Strasse 14

60431 Frankfurt

Telefon: +49 (69) 9566-33511

Telefax: +49 (69) 709097-9000

http://www.bundesbank.de

Telefon: +49 (69) 9566-3511

Fax: +49 (69) 9566-3077

E-Mail: presse@bundesbank.de

![]()