Highlights:

- Multiple gold outcrops across the 3 km x 6 km permit area grading up to 15.1 g/t (12 samples, range 0.01 to 15.1 g/t Au, average 4.35 g/t Au).

- Drill ready target, with better channel samples including 3.8m at 4.5 g/t Au and 1.6m at 5.4 g/t.

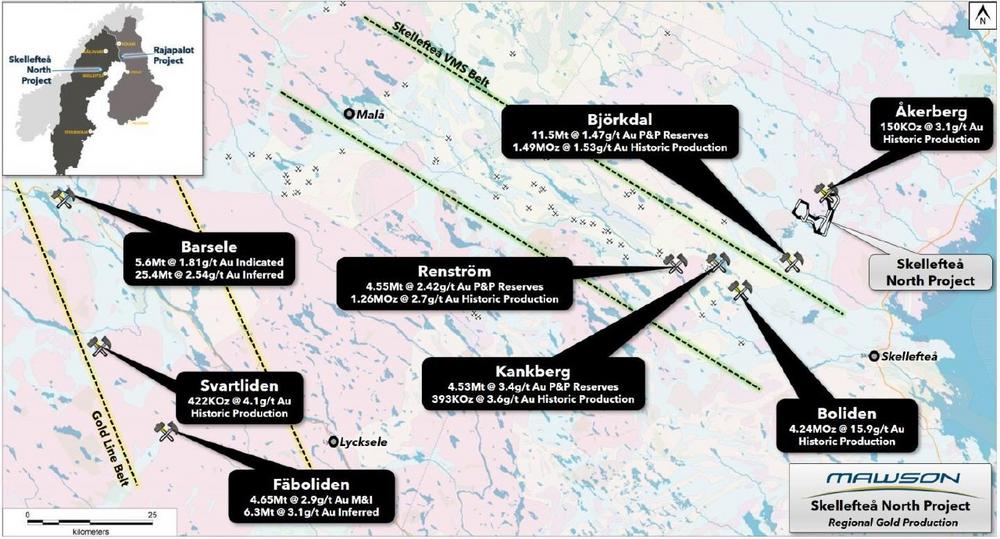

- Located in renowned Skellefte Belt, a modern goldfield with over 6 million ounces of gold produced.

- Right to acquire up to 85% in the project over a 10-year period.

- Excellent strategic fit; leveraging local exploration team and track record, and consolidating the Nordic focus through addition of a year-round drilling prospect to complement our advanced Rajapalot project.

Mr. Fairhall, CEO, states, “Skelleftea North is a hugely exciting drill ready project, in a world-class mining belt, flanked by 4 mines that have extracted over 6 million ounces of gold combined. Fennoscandia is ripe for discovery and we have seen a race for ground and new discoveries resulting from un-precedented exploration activity in the region. Being almost completely covered by till, outcrops of this quality are rare in the Nordics – the last of which in Mawson’s portfolio was Palokas, which underwrote our growing million-ounce gold equivalent discovery at Rajapalot. We will leverage that team’s decade long experience in the region to advance this Project, thereby adding further value creation optionality for Mawson’s shareholders.”

The Skelleftea North Gold Project consists of 2,500 ha of contiguous 100%-owned claims located in the well-endowed Skellefte Mining District of Northern Sweden, located 40 km north-northwest of the city of Skelleftea (Figure 1). The Skellefte Belt comprises a poly-deformed, Paleoproterozoic-aged volcano-sedimentary rocks containing several large gold deposits that have produced in excess of 6 Moz of gold (most notably from the Boliden, Bjorkdal and Kankberg gold mines, see Figure 1). Swedish mining giant Boliden has dominated production in the district for nearly a century and has established processing facilities at the site of the historical Boliden gold mine (historical production of 4 Moz at 15.1 g/t Au) located ~22 km to the southwest and smelting facilities in Skelleftea. Mandalay Resources Corporation operates the Bjorkdal gold mine located 8 km to the southwest of the Project, having historically produced over 1.3 Moz Au with a further 1 Moz Au remaining in M&I resources. The Skelleftea North Project is also flanked by the Akerberg open-pit mine located some 2 km to the northwest, which historically produced 150 Koz Au (at 3.1 g/t Au) in the early 2000’s. In addition, there are 85 known polymetallic sulfide deposits within the Skellefte Mining District, the largest being the currently-operating Renstrom and Kristineberg mines having produced over 14 Mt and 32 Mt of polymetallic sulfide ore respectively.

The Project area contains outcropping gold mineralization across the 3 km x 6 km land package (see Figure 2), with grab samples collected grading up to 15.1 g/t Au. Gold is hosted within a structurally controlled quartz-vein system containing arsenopyrite gangue. Veins occur as localized ‘vein-swarms’ within a late sub-vertical mafic dyke intruded within an interpreted pre-existing structural feature. Weak deformation fabrics observed within the host dyke suggest the gold-mineralization has a late post–deformational emplacement age, and therefore interpreted as a late-orogenic, epigenetic deposit style.

The most advanced target on the Project is at the Dalbacka Prospect (see Figure 3), where an approximately180m long outcropping mafic dyke intrudes a deformed pyrrhotite-bearing graphitic black shale that extends as a clear magnetic anomaly to the east and west under cover for approximately 1.5 km (see Figure 4). The full outcropping extent of the mafic dyke contains gold-bearing quartz/arsenopyrite mineralization across both its outcropping length and width (between 3m and 10m – see Table 1). Highlighted results from Elemental’s exploration and Mawson’s confirmatory work include:

- Channel TR119948 3.8m at 4.5 g/t Au (true width approx. 80%).

- Channel TR119944 1.6m at 5.4 g/t (true width).

- 5 grab samples cross spanning the outcrop averaging 5.1 g/t Au (range 0.8 to 10.0 g/t Au).

- Isolated 6.0 g/t Au sample 1.8 km west of main outcrop, broadly along trend.

- Isolated 15.1 g/t Au sample found in quartz-arsenopyrite vein in the Storberget Prospect located in the north of the Project.

The Dalbacka Prospect is located on privately owned land and is fully permitted for year-round drilling. Following a detailed ground magnetic survey, drilling will commence in Q2 2022.

Channel samples are considered representative of the in-situ mineralization sampled, while grab samples are selective by nature and are unlikely to represent average grades on the property.

Option Agreement Terms

Under the terms of the Option Agreement, Mawson has paid Elemental C$20,000 as reimbursement for certain costs incurred to maintain the Project in good standing, and has issued 260,000 common shares (the “Common Shares”) to Elemental at an issue price of C$0.16 per common share. The Common Shares are subject to a statutory hold period expiring on May 18, 2022.

Mawson has the right to earn up to 85% of the project and enter into a joint venture. Key terms of the Option Agreement:

- An option to earn an initial 75% interest, exercisable by Mawson subject to incurring aggregate expenditures of C$3,000,000 over 4 years, provided that a minimum C$220,000 is spent in year one (inclusive of C$20,000 already paid) and C$280,000 in year two.

- An option to earn an additional 10% interest (for 85% total) exercisable by the Mawson upon completion of a NI 43-101 compliant pre-feasibility or feasibility study.

- Mawson will be the Operator during the option period.

- Following Mawson earning 85%, formation of a standard joint venture (“JV”), with both parties contributing to ongoing funding.

- Should either party dilute below 10%, the diluting party’s interest will convert to a 2% Net Smelter Royalty (“NSR”). The non-diluting party will hold an exclusive right to acquire 50% of the NSR for C$1,500,000 at any time prior to the date that is 12 months after commercial production.

Mawson will utilize the services of Elemental to manage certain operational and statutory responsibilities on the Project.

The securities offered have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor in any other jurisdiction.

Technical Background and Qualified Person

The Qualified Person, Michael Hudson, Executive Chairman of Mawson Gold, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

Channel samples were taken with a powered rock-saw with continuous sampling taken across the full length of each channel, at a nominal 1m sampling interval. Sample locations were measured with a handheld GPS, and sent to three certified laboratories to conduct gold assay analysis. Samples were taken and transported by Mawson and Elemental Exploration personnel or commercial transport from site to the CRS Minlab Oy facility in Kempele, Finland, or to the ALS Global sample preparation facility in Mala, Sweden. Samples submitted to Kempele were prepared and analyzed for gold using the PAL1000 technique which involves grinding the sample in steel pots with abrasive media in the presence of cyanide, followed by measuring the gold in solution with flame AAS equipment. Samples were also sent to MSA Laboratory in Langley, British Colombia for 50g fire assay and ICP finish method Au ICP-AED. Samples submitted to Mala were analyzed using 30 g fire assay with AA finish method Au-AA25. The QA/QC program of Mawson consists of the systematic insertion of certified standards of known gold content. In addition, all three laboratories insert blanks and standards during the analytical process.

Regional production and resource estimate sources are hyperlinked. These historical data have not been verified by Mawson and are quoted for information purposes only.

Gold equivalent “AuEq” = Au+(Co/1005) based on assumed prices of cobalt US$23.07/lb and gold US$1,590/oz. Details of Mawson’s Inferred Mineral Resource can be read in the Company’s news release dated August 26, 2021 (here).

About Mawson Gold Limited (TSX:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Gold Limited is an exploration and development company. Mawson has distinguished itself as a leading Nordic Arctic exploration company with the flagship Rajapalot gold-cobalt project in Finland, and option to earn up to 85% in the Skelleftea Gold Project in Sweden. Mawson also owns or is joint venturing into three high-grade, historic epizonal goldfields covering 470 km² in Victoria, Australia and is well placed to add to its already significant gold-cobalt resource in Finland.

About Elemental Exploration Scandinavia AB

Elemental Exploration Scandinavia AB is a privately-owned, Swedish-based exploration company founded in 2020 by Ms. Amanda Scott and Dr. Thomas Fromhold, both qualified exploration geologists residing in Sweden, with experience in Australia and the Nordics. Notably Dr. Fromhold held the position of Exploration Manager for 4 years with Mandalay Resources Corporation at their Swedish operations. Amanda Scott is credited with the discovery of high-grade iron ore at Jigalong in the East Pilbara and the Amanda gold deposit in the Pilbara, and is currently a non-executive director of ASX-listed Hannans Ltd.

On behalf of the Board,

"Ivan Fairhall”

Ivan Fairhall, Director and CEO

Further Information

www.mawsongold.com

1305 – 1090 West Georgia St., Vancouver, BC, V6E 3V7

Mariana Bermudez (Canada), Corporate Secretary, +1 (604) 685 9316, info@mawsongold.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, but not limited to: capital and other costs varying significantly from estimates; changes in world metal markets; changes in equity markets; ability to achieve goals; that the political environment in which the Company operates will continue to support the development and operation of mining projects; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; risks related to negative publicity with respect to the Company or the mining industry in general; reliance on a single asset; planned drill programs and results varying from expectations; unexpected geological conditions; local community relations; dealings with non-governmental organizations; delays in operations due to permit grants; environmental and safety risks; and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson’s most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Mawson, in light of management’s experience and perception of current conditions and expected developments, Mawson can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()