A Message from Peter Dembicki, President, CEO & Director:

“We are in a robust silver system with substantial grades, both on surface and in our drill holes, which we believe is the start of a potential major silver discovery. The work from our first phase of drilling and subsequent review has identified strong potential for a porphyry discovery nearby. This is a significant development for our Curibaya project, as we are located on one of the most prolific porphyry belts in the world, near some of the largest porphyry mines in Latin America.”

Targeting Advancements:

Precious Metals Window:

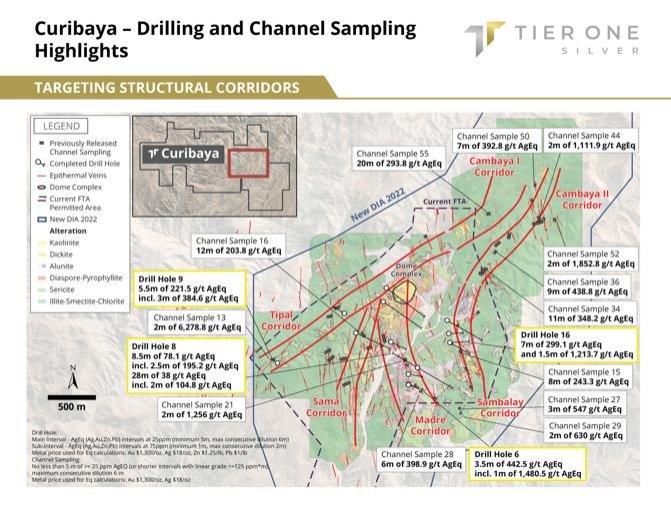

The key technical advancement from the first phase of drilling at Curibaya is the recognition of a precious metals window that is linked to higher elevations within the project area. The ridges that host the veins within the Tipal, Sama, Madre and Sambalay corridors have a maximum elevation of approximately 2,100 m, whereas vein mineralization in the northeastern area of the project, including the Cambaya target area, has elevations of approximately 2,200 m – 2,400 m (Figure 2). Given the increase in elevation of approximately 300 m, the outcropping epithermal veins from southwest to northeast and the higher stratigraphic level to the northeast, the Company has interpreted that there has been less erosion in the northeast area of the project and therefore there is a higher potential for preserved epithermal mineralization. This is corroborated with the observed illite- smectite clay alteration.

The precious metals window observed at Cambaya indicates an erosion level approximately 150 m below the paleo watertable, whereas vein outcrops to the southwest have been eroded approximately 300 m deeper at the Sama, Tipal, and Madre corridors. This demonstrates that the corridors in the southwest are 450 m beneath the paleosurface, which is consistent with the common illite alteration observed within those corridors. This provides a precious metals corridor of approximately 300 m – 400 m within the Cambaya target area, where channel samples included 20 m of 293.8 g/t AgEq, 11 m of 348.2 g/t AgEq, 7 m of 392.8 g/t AgEq, 9 m of 438.8 g/t AgEq, 2 m of 1,111.9 g/t AgEq and 2 m of 1,852 g/t AgEq. In addition, Tier One’s technical team believes that the 1 km northern extension from the drill intercept of 1.5 m of 1,213.7g/t AgEq at the Sambalay corridor is highly prospective, as elevation is gained to the north toward Cambaya, and therefore the vertical extent of the precious metals window is increasing in that direction (Figure 3).

Stratabound Sub-horizontal Bulk Tonnage Silver Targets:

Drilling at the Madre corridor has identified the potential for sub-horizontal stratabound mineralization that is hosted within the Inogoya siltstones, just beneath the unconformity with the overlying Toquepala volcanic sequence. Drill holes 1 and 8 intersected 31 m of 27.4 g/t AgEq and 28 m of 38.0 g/t AgEq, respectively, within the Inogoya siltstones (Figure 4). The primary target associated with the sub-horizontal mineralization is the intersection of sub-vertical veins within the stratabound mineralization, as mineralization in this setting has the potential to host higher tonnages within the mineralized system. The stratabound mineralization is open to the north, south and east.

Copper Porphyry Potential:

The first phase of drilling and surface work has provided several lines of evidence that a porphyry target exists in the central region of the mineralized system, as it is currently defined. An analysis of vein geochemistry across the property has demonstrated concentric zonation with copper-lead-zinc zoning outward into lead +/- copper and then zinc +/- lead in the peripheral zone (Figure 5). This geochemical zonation is consistent with porphyry systems and the central copper-lead-zinc zone would be the primary target area at depth. Within the copper – lead – zinc geochemical core, weak skarn mineralization is observed on surface, indicating a proximity to intrusives. Small scale 1 m – 2 m wide porphyry dykes and associated magnetite veinlets were intersected in the Madre and Tipal corridors, also indicating the potential for a proximal porphyry. In addition, drill holes 6 and 8 had intercepts of molybdenum (Mo) grading 5 m of 85 ppm Mo and 44 m of 52 ppm Mo, respectively, providing a potential vector to a porphyry system at depth (Figure 3). There are also magnetic and chargeability anomalies defined at a depth of 400 m, which have not been drill tested, and may represent either intrusions or potassic alteration and sulphidation at these depths.

A Message from Christian Rios, SVP of Exploration:

“We are looking forward to expanding the high-grade silver mineralization encountered in our 2021 program. The primary goal of the next phase will be to define the geometry of the structures and the vertical potential, as well as to drill additional untested areas where we have received highly prospective channel sample results. We are also excited about the strong evidence of a porphyry target linked to the epithermal structures, which we also plan to drill test.”

Phase II Drill and Exploration Program:

The Company plans to focus its phase II drill program along the northern extension of the Sambalay corridor and to drill test the Cambaya corridor for the first time. Collectively, these target areas represent the greatest interpreted vertical extent within the precious metal window on the property. To effectively target these corridors, the Company plans to conduct detailed structural mapping to define areas where vein orientations change where high-grade mineralization could be concentrated. In addition, the Company plans to conduct a CSAMT (controlled source audio-frequency magneto-tellurics) survey in the central portion of the property to help define porphyry targets. The purpose of this survey is to define the resistivity properties at depth, where zones of lower resistivity can indicate zones of intense hydrothermal alteration. Upon completion of targeting, the Company plans to complete a two-drill-hole program to test for an underlying porphyry to the epithermal system.

Christian Rios (SVP of Exploration), P.Geo, is the Qualified Person who has reviewed and assumes responsibility for the technical contents of this press release.

ON BEHALF OF THE BOARD OF DIRECTORS OF TIER ONE SILVER INC.

Peter Dembicki

President, CEO and Director

For further information on Tier One Silver Inc., please contact Natasha Frakes, Vice President of Communications at (778) 729-0600 or info@tieronesilver.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

About Tier One

Tier One Silver is an exploration company focused on creating value for shareholders and stakeholders through the discovery of world-class silver, gold and base metal deposits in Peru. The Company’s management and technical teams have a strong track record in raising capital, discovery and monetization of exploration success. The Company’s exploration assets in Peru include: Hurricane Silver, Coastal Batholith, Corisur and the flagship project, Curibaya. For more information, visit www.tieronesilver.com.

Curibaya Drilling

Analytical samples were taken by sawing HQ or NQ diameter core into equal halves on site and sent one of the halves to ALS Lab in Arequipa, Peru for preparation and then to Lima, Peru for analysis. All samples are assayed using 30 g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were greater or near 10,000 ppm Cu, 10,000 ppm Pb or 100 ppm Ag the assay were repeated with ore grade four acid digest method (Cu, Pb, Ag-OG62). Where OG62 results were greater or near 1,500 ppm Ag the assay were repeated with 30 g nominal weight fire assay with gravimetric finish (Ag-GRA21).

QA/QC programs for 2021 core samples using company and lab duplicates, standards and blanks indicate good accuracy and precision in a large majority of standards assayed.

Silver equivalent grades (AgEq) were calculated using silver price of US$18/oz, gold price of US$1,300/oz, zinc price of US$1.25/lb, and lead price of US$1.00/lb. Metallurgical recoveries were not applied to the silver equivalent calculation.

Intercepts were calculated with no less than 5 m of >= 25 g/t AgEq with maximum allowed consecutive dilution of 6 m. True widths of mineralization are unknown based on current geometric understanding of the mineralized intervals.

Forward Looking Information and General Cautionary Language

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, “forward-looking statements”) that relate to the Company’s current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result”, “are expected to”, “expects”, “will continue”, “is anticipated”, “anticipates”, “believes”, “estimated”, “intends”, “plans”, “forecast”, “projection”, “strategy”, “objective” and “outlook”) are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release. In particular and without limitation, this news release contains forward-looking statements in regard to the Company’s exploration plans.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()