Highlights

- Wharekirauponga (“WKP”) Indicated Resource increased 53% from 1.0 million tonnes (“Mt”) at 13.4 g/t gold for 0.42 million ounces (“Moz”) gold including 0.8 Moz silver to 1.5 Mt at 13.5 g/t gold for 0.64 Moz gold including 1.27 Moz silver. Inferred Resources of 2.3 Mt at 9.4 g/t gold for 0.7 Moz of gold including 1.6 Moz of silver remain, presenting a significant opportunity for future resource conversion.

- Year-on-year increase of 0.31 Moz Measured and Indicated Resources at Waihi, New Zealand, to 13.9 Mt at 4.81 g/t gold for 2.15 Moz gold, due to the conversion of Inferred Resources at Martha and WKP underground projects.

- Includes first Indicated Resources for the Palomino underground deposit at Haile, U.S.A; 2.3 Mt at 2.79 g/t gold for 0.20 Moz of gold. Inferred Resources of 3.6 Mt at 2.3 g/t gold for 0.26 Moz remain to be converted.

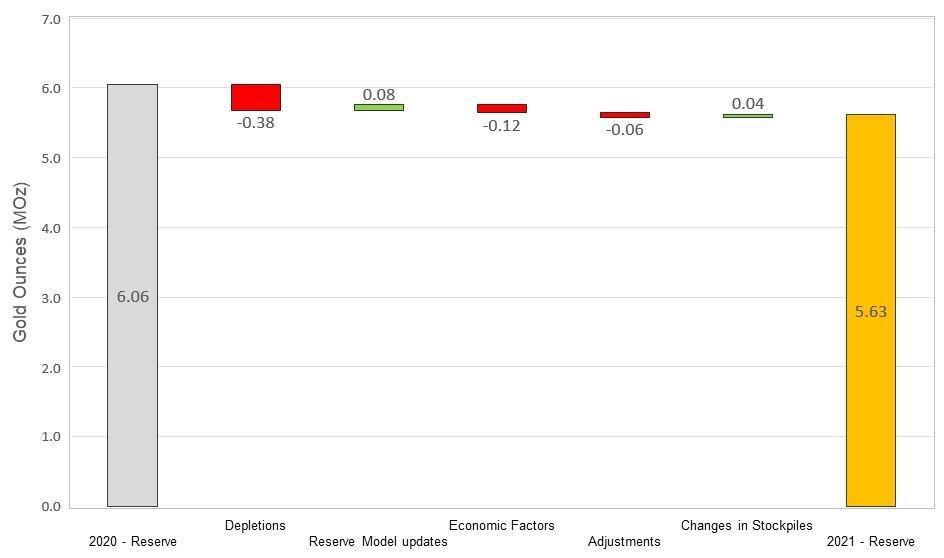

- Proven and Probable Reserves stood at 131 Mt at 1.33 g/t gold for 5.63 Moz gold, including 8.02 Moz silver and 0.15 Mt copper, a 0.43 Moz gold decrease year on year mainly due to mining depletion.

- Measured and Indicated Resources, inclusive of Mineral Reserves stood at 199 Mt at 1.43 g/t gold for 9.13 Moz gold, including 14.4 Moz silver and 0.17 Mt copper, a 0.92 Moz gold decrease year on year largely due to mining depletion and a reduction in the Round Hill open pit resource at Macraes, New Zealand.

Scott Sullivan, Acting President and CEO of OceanaGold said, “The recent resource conversion drill results and updated Indicated and Inferred Resources highlight WKP has the makings of a quality gold mine. The 2021 drill program at WKP saw a very high conversion rate of Inferred Resources to Indicated Resources which resulted in the significant increase in Indicated Resources from 1.0 Mt at 13.4 g/t gold for 0.42 Moz gold to 1.5 Mt at 13.5 g/t gold for 0.64 Moz gold including 1.27 Moz silver. The 2022 drill program is building on these exceptional results with a focus on delivering 1 Moz in the short-term at WKP in support of the up-coming pre-feasibility study.”

“Our Reserves and Resources continue to provide a strong foundation for the Company as we steadily increase our gold production over the next three years. The underground potential at Haile is growing with the introduction of the Palomino Indicated Resource and our investment in both exploration and resource conversion drilling. Once we develop the underground infrastructure at Horseshoe we will also have further opportunity to convert resources.”

Reserves

As of 31 December 2021, OceanaGold’s Proven and Probable (“P&P”) Reserves stood at 131 Mt at 1.33 g/t gold for 5.63 Moz of gold, including 8.02 Moz of silver and 0.15 Mt of copper, representing a 0.43 Moz decrease in gold Reserves year-on-year (see Table 1) largely due to mining depletion.

Resources

As of 31 December 2021, OceanaGold’s Measured and Indicated (“M&I”) Resources stood at 199 Mt at 1.43 g/t gold for 9.13 Moz of gold, including 14 Moz of silver and 0.17 Mt of copper (Table 2). Mineral Resources are reported inclusive of Mineral Reserves.

On a consolidated basis, OceanaGold’s M&I Resources decreased by 0.92 Moz (Figure 2). Decreases were mainly due to mining depletion across the Company’s operations as well as the reduction in the reportable Round Hill Open Pit Resource at Macraes following the completion of an internal prefeasibility-level study (see section on Macraes). The decreases were partially offset by gains due to resource conversion drilling-related resource updates for Palomino at Haile, WKP and Martha at Waihi, and Golden Point at Macraes.

Note: “Depletions” refer to 2021 mining depletion, “Resource Model Updates” represent drilling-related resource changes (growth or reductions) or initial resource declarations, “Economic Factors” relate to mining cost and cut-off grade changes, “Adjustments” relate to changes in mining method assumptions (e.g. open pit versus underground).

As of 31 December 2021, OceanaGold’s Inferred Resources stood at 62 Mt at 1.9 g/t gold for 3.9 Moz of gold, including 7.5 Moz of silver and 0.04 Mt of copper (Table 3). Year on year this represents a 0.5 Moz decrease mainly due to the conversion of Inferred Resources at Waihi, Macraes and Haile.

New Zealand

Waihi

Underground P&P Reserves at Waihi stood at 4.77 Mt at 4.2 g/t gold for 0.64 Moz gold including 2.23 Moz silver with reserve growth at Martha offsetting mining depletion (Figure 4). No open pit reserves are reported.

The Waihi underground M&I Resources stood at 7.3 Mt at 7.45 g/t gold for 1.76 Moz gold, including 4.99 Moz silver and open pit M&I Resources stood at 6.6 Mt at 1.86 g/t gold for 0.40 Moz gold, including 2.89 Moz silver (Figure 5). Combined underground and open pit M&I Resources totalled 13.9 Mt at 4.81 g/t gold for 2.15 Moz gold, including 7.87 Moz silver, representing a year-on-year increase of 0.31 Moz due to the conversion of Inferred Resources at WKP and Martha, respectively:

- Martha Indicated Resources 5.8 Mt at 5.93 g/t gold for 1.11 Moz gold including 3.71 Moz silver.

- Martha Inferred Resources 2.9 Mt at 5.1 g/t gold for 0.47 Moz gold including 2.0 Moz silver.

- WKP Indicated Resources 1.5 Mt at 13.5 g/t gold for 0.64 Moz gold including 1.27 Moz silver.

- WKP Inferred Resources of 2.3 Mt at 9.4 g/t gold for 0.7 Moz gold including 1.6 Moz silver.

Underground Resources at Waihi

During 2022, the Company expects to drill 21,235 metres at Martha Underground (“MUG”) with a focus on resource conversion (11,875 metres) and resource extension (9,360 metres). This programme is designed to improve resource confidence and to test opportunities proximal to mine design.

WKP is located in the upper North Island of New Zealand, approximately 10 kilometers north of the Martha Underground and existing Waihi facilities. WKP is a rhyolite-hosted, low sulphidation epithermal quartz vein system. The rhyolites have undergone pervasive hydrothermal alteration, often with complete replacement by quartz and adularia with minor illite and/or smectite clay. Gold mineralisation occurs in association with quartz veining developed along two types of structurally controlled vein arrays. The principal veins occupy laterally continuous, NE trending (025-47°), moderately dipping (60-65°) district-scale graben step faults, reaching up to 10 metres in width. Subsidiary, extensional veins (1-100 centimetres wide) are developed between or adjacent to the principal fault hosted veins.

The Company expects to drill 16,775 metres at WKP primarily on resource conversion in 2022 to increase the Indicated Resources in support of the prefeasibility study scheduled for release in 2023.

The Waihi Inferred Resources stood at 1.5 Moz gold, a small decrease year on year (Figure 6). The Inferred Resources at Waihi present a significant opportunity for future conversion.

Resource Model Performance

Table 4 summarizes the Waihi underground resource model reconciliations for 2018 to 2021. Reserve modifying factors have been applied for ore loss and dilution. The resource model to mill-adjusted mine reconciliation data from various ore sources for the four years to 2021 show variable performance from year to year with a reasonable long-term average performance; +8% for tonnes, -2% for grade and +7% for contained gold.

Mining during 2018, 2019 and 2020 was largely on the Correnso vein for which reconciliation was in line with expectations. The reconciliation for 2021 largely represents mining at MUG and shows greater variance. However, the mined MUG tonnage to-date is not considered to be large or geologically representative, reflecting less than 5% of the total MUG reserve. The majority of ore mined at MUG to-date has been development ore rather than stoping ore, and with limited grade control coverage. That said, the greater variance in reconciliation performance is in areas with higher geological and grade complexity, particularly in the smaller, subsidiary veins. The modelling and classification of these veins is under review and will continue as mining progresses in 2022.

Macraes

The P&P Reserves for Macraes stood at 39.0 Mt at 0.95 g/t gold for 1.20 Moz gold with 0.98 Moz in the open pits and 0.22 Moz in the Frasers and Golden Point Underground mines. Year-on-year drilling-related underground reserve growth at Golden Point Underground and within the open pits has partially offset 2021 mining depletion for a net 0.1 Moz decrease.

The Macraes M&I Resources stood at 84.6 Mt at 0.93 g/t gold for 2.52 Moz of gold, including 6.9 Mt at 2.53 g/t gold for 0.56 Moz of gold for the Frasers Underground and Golden Point Underground mines. The year-on-year net decrease in M&I Resources of 1.08 Moz is largely due to a 0.95 Moz reduction for the Round Hill Open Pit Resource, Macraes Open Pit and underground mining depletion as well as write-downs at Frasers Underground where development retreat has reduced the prospects of future resource extraction (see Adjustments in Figure 8).

The reduction of the Round Hill Open Pit Resource followed the completion of an internal study assessing a larger Round Hill Open Pit. Earlier, less detailed studies had provided positive outcomes for the relocation of the processing plant and Mixed Tailings Impoundment (“MTI”), both required to develop the larger Round Hill Open Pit. The financial analysis for the more recent and detailed study however, returned a negative NPV outcome due to additional capital requirements of moving the processing plant. On this basis and current assumptions, reasonable prospects of eventual economic extraction could no longer be maintained for the portion of the pit that required relocation of the plant and MTI. The Round Hill Open Pit M&I Resource decreased from 54 Mt at 0.92 g/t gold for 1.61 Moz to 21 Mt at 0.97 g/t gold for 0.66 Moz.

Macraes Inferred Resources stood at 24 Mt at 0.7 g/t gold for 0.6 Moz of gold, a decrease of 0.2 Moz from the previous year, due mainly to the conversion of Inferred Resources to the Indicated category and, to a lesser extent, mining depletion (Figure 9).

Reserve Model Performance

Table 5 summarizes the combined open pit and underground resource model reconciliations for 2018 to 2021.

The reserve model to mill-adjusted mine reconciliation data for the four years to 2021 show variable performance from year to year, albeit the long-term average performance for this period has been reasonable; +9% for tonnes, -3% for grade and +6% for contained gold. While the long-term performance has been reasonable, the grade performance for 2020 and 2021 was less than 2018 and 2019, although the contained gold reconciliation has been positive. The causes for the recent grade performance have been a combination of complex mineralization styles, the realization of additional low-grade mineralization in grade control, difficulty in achieving representative drilling coverage at Gay Tan Open Pit due to limited drill rig access, and in 2021, near-surface depletion at Deepdell Open Pit. While geological complexity remains in 2022, resource model performance is expected to return to long term performance. While annual reconciliation fluctuations are expected to continue, the resource estimates are believed to provide an acceptable basis for medium to long term mine planning purposes.

Blackwater

Resources for the Blackwater Project remain on the Company’s inventory and are unchanged from the 31 December 2020 reported resources.

United States of America

Haile

P&P Reserves totalled 45.4 Mt at 1.75 g/t gold for 2.55 Moz of gold including 3.23 Moz of silver. Of the 2.55 Moz, the Haile Underground contributes 0.42 Moz. Year on year P&P Reserves have decreased 0.29 Moz due to a combination of mining depletion and increased mining costs (Figure 10).

As announced on 9 February 2022, OceanaGold completed an internal technical review of the Haile mine during 2021. An outcome of this technical review was an adjustment to the reserve cut-off grade in line with revised cost estimates for mining, processing, and general and administration costs. This has resulted in a reduction in P&P Reserves of approximately 0.12 Moz as shown in Figure 11.

Total Haile M&I Resources stood at 52.9 Mt at 1.79 g/t gold for 3.04 Moz of gold, including 3.61 Moz of silver. Of the 3.04 Moz of gold, the Haile underground contributes 0.73 Moz which includes the first-time reporting of Indicated Resources for the Palomino Underground deposit; 2.3 Mt at 2.79 g/t gold for 0.20 Moz of gold. Year on year M&I Resources decreased by 0.14 Moz due the combination of mining depletion and a small decrease in the resource reporting shell due to revised costs as noted above (Figure 11). Resource growth at Palomino partially offset these decreases.

Inferred Resources stood at 11 Mt at 2.0 g/t gold for 0.7 Moz gold. Year-on-year the Inferred Resources decreased 0.4 Moz largely due to infill drilling-related conversion to Indicated Resources (Figure 12).

Palomino Underground Deposit

Palomino is a gold deposit located approximately 650 metres southwest of the Horseshoe deposit and 300 metres below surface (Figure 13).

The deposit dimensions are approximately 400 metres long x 70 metres high x 90 metres wide. Lozenge-shaped mineralized zones strike ENE, dip NW and plunge gently NE. Diamond drillhole spacing ranges from 20 to 70 metres. Fine-grained gold is hosted in pyritic and silicified siltstone and intrusive rocks along a steeply SE-dipping, ENE-striking contact with barren dacite flows. Mineralization is truncated by several NNW-striking, sub-vertical, 1 to 25 metres thick diabase dikes.

The resources are reported within a Mine Stope Optimised volume using a US$1,700 per oz gold price. Due to the diffuse grade boundaries, material not classified as Inferred or Indicated Resource is included as dilution at zero grade. Indicated Resources are currently estimated at 2.3 Mt at 2.79 g/t gold for 0.20 Moz of gold. Inferred Resources of 3.6 Mt at 2.3 g/t gold for 0.26 Moz remain to be converted.

Reserve Model Performance

Table 6 summarizes the open pit resource model reconciliations 2018 to 2021. The resource model to mill-adjusted mine reconciliation data for the four years to 2021 show variable performance from year to year albeit the long-term average performance for this period shows +12% for tonnes, -4% for grade and +8% for contained gold. Note that the four-year aggregated grade reconciliation is negatively skewed by low mining selectivity during 2020 which resulted in excessive mining dilution during that year. More selective mining practices re-introduced during 2021 have resolved this.

While annual reconciliation fluctuations are expected to continue, the open pit resource estimates are believed to provide an acceptable basis for medium to long term mine planning purposes.

Philippines

Didipio

Didipio P&P Reserves stood at 42.2 Mt at 0.91 g/t gold for 1.23 Moz of gold, including 2.57 Moz of silver and 0.15 Mt of copper, a year-on-year decrease due to 2021 mining depletion (Figure 14) as the production ramp-up continues to progress ahead of schedule. A small decrease is noted in Adjustments due to exclusion of sub-economic low-grade material at the tail end of the life of mine schedule.

Didipio M&I Resources stood at 47.8 Mt at 0.92 g/t gold for 1.41 Moz of gold, including 2.88 Moz of silver and 0.17 Mt of copper, a small year-on-year decrease due to 2021 mining depletion (Figure 15), as the production ramp-up continues to progress ahead of schedule. Surface stockpiles include medium and low-grade stocks. 17.6 Mt at 0.38 g/t gold and 0.34% copper remains from open pit mining during 2012 to 2017 (mined to a 0.4 g/t AuEq cut-off) and an additional 5.3 Mt at 0.18 g/t gold and 0.15% copper (mined to a 0.27 g/t AuEq cut-off).

Inferred Resources stood at 0.4 Moz of gold, 0.6 Moz of silver and 0.04 Mt of copper, no change year-on-year.

Reserve Model Performance

The reconciliation in Table includes mining from May 2018 to December 2021 covering the period of ramp up for underground mining. The mill feed for this period included rehandled open pit stockpiles, underground development and stope ore. Mining of a crown pillar at the base of the open pit to allow geotechnical strengthening with cement commenced in 2021 and provided the main source of 2021 mill feed. Grade control sampling of the crown pillar was sub-optimal because the focus was on geotechnical strengthening rather than ore extraction. When this mill feed source is exhausted in early 2022, the reconciliation is expected to improve.

Other

OceanaGold’s interest in the Sam’s Creek project in New Zealand is 18.47%.

Filing of Technical Reports

The company will lodge updated NI 43-101 Technical reports for both Didipio and Haile on 31 March 2022 to provide technical updates for both projects.

In line with the requirements of the listing rules of the Australian Stock Exchange (“ASX”), the Company has separately filed material summaries and JORC Table 1 information related to the Resource and Reserves with the ASX. These can be found at www.asx.com.au, and is also available on the Company’s website at https://oceanagold.com/investor-centre/tsx-and-asx-announcements/.

Authorised for release to market by OceanaGold Corporate Company Secretary, Liang Tang.

For further information please contact:

Investor Relations

Sabina Srubiski

Tel: +1 604 351 7909

IR@oceanagold.com

Media Relations

Melissa Bowerman

Tel: +61 407 783 270

info@oceanagold.com

www.oceanagold.com | Twitter: @OceanaGold

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

About OceanaGold

OceanaGold is a multinational gold producer committed to the highest standards of technical, environmental, and social performance. For 31 years, we have been contributing to excellence in our industry by delivering sustainable environmental and social outcomes for our communities, and strong returns for our shareholders. Our global exploration, development, and operating experience has created an industry-leading pipeline of organic growth opportunities and a portfolio of established operating assets including Didipio Mine in the Philippines; Macraes and Waihi operations in New Zealand; and Haile Gold Mine in the United States of America.

Technical Disclosure

General

All Mineral Reserves and Mineral Resources were calculated as of 31 December 2021 and have been calculated and prepared in accordance with the standards set out in the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves dated December 2012 (the “JORC Code”) and in accordance with National Instrument 43-101 of the Canadian Securities Administrators (“NI 43-101”). The JORC Code is the accepted reporting standard for the Australian Stock Exchange Limited (“ASX”).

The definitions of Ore Reserves and Mineral Resources as set forth in the JORC Code have been reconciled to the definitions set forth in the CIM Definition Standards. If the Mineral Reserves and Mineral Resources were estimated in accordance with the definitions in the JORC Code, there would be no substantive difference in such Mineral Reserves and Mineral Resources.

Competent / Qualified Persons

Macraes: Any updates of Mineral Resources for Macraes open pits have been verified and approved by J. Moore while the updates of Mineral Resources for Macraes underground operations have been verified and approved by M. Grant. Mineral Reserves for Macraes open pits have been verified and approved by, or are based on information prepared by, or under the supervision of, P Doelman. The Mineral Reserves for Macraes underground have been verified and approved by or are based upon information prepared by, or under the supervision of, S. Mazza.

Blackwater: Any updates of Mineral Resources for Blackwater have been verified and approved by J. Moore.

Waihi: Any updates of Mineral Resources for Waihi’s Martha open pit and Wharekirauponga Underground have been verified and approved by, or are based on information prepared by, or under the supervision of, J. Moore. Any updates of Mineral Resources for Waihi’s Gladstone open pit and Martha Underground have been verified and approved by, or are based on information prepared by, or under the supervision of, L. Crawford-Flett. The Mineral Reserves for Waihi have been verified and approved by, or are based on information prepared by, or under the supervision of D. Townsend for underground.

Haile: The updates of Mineral Resources for Haile open pit and underground have been verified and approved by, or are based on information prepared by, or under the supervision of, J. G. Moore. The updates of Mineral Reserves for Haile open pits have been verified and approved by, or are based on information prepared by, or under the supervision of, G. Hollett and the Mineral Reserves for Haile underground have been verified and approved by or are based upon information prepared by, or under the supervision B. Drury.

Didipio: The Mineral Resources for Didipio have been verified and approved by, or are based on information prepared by, or under the supervision of, J. Moore while the Mineral Reserves for Didipio underground have been verified and approved by or are based upon information prepared by, or under the supervision P. Jones.

Messrs Crawford-Flett, Doelman, Grant and Townsend are full-time employees of the Company’s subsidiary, Oceana Gold (New Zealand) Limited. Messrs Hollett, Jones, Mazza and Moore are full-time employees of the Company’s subsidiary, OceanaGold Management Pty Limited. Ms Drury is a full-time employee of the Company’s subsidiary, Haile Gold Mine, Inc.

Mr Hollett is a Professional Engineer registered with Engineers and Geoscientists of British Columbia. Messrs Doelman, Jones, Mazza, Moore and Townsend are Members and Chartered Professionals with the Australasian Institute of Mining and Metallurgy. Mr Grant is a member of the Australian Institute of Geologists. Ms Drury is a Registered Member with the Society of Mining, Metallurgy & Exploration.

All such persons are “qualified persons” for the purposes of NI 43-101 and have sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity which they are undertaking to qualify as a “competent person” as defined in the JORC Code.

Ms Drury and Messrs Crawford-Flett, Doelman, Grant, Hollett, Jones, Mazza, Moore, and Townsend consent to inclusion in this public release of the matters based on their information in the form and context in which it appears. The estimates of Mineral Resources and Mineral Reserves contained in this public release are based on, and fairly represent, information and supporting documentation prepared by the named qualified and competent persons in the form and context in which it appears.

Technical Reports

For further scientific and technical information supporting the disclosure in this media release (including disclosure regarding Mineral Resources and Mineral Reserves, data verification, key assumptions, parameters, and methods used to estimate the Mineral Resources and Mineral Reserves, and risk and other factors) relating to the Didipio Gold-Copper Mine, the Macraes Mine, the Haile Gold Mine, the Waihi Gold Mine and the Blackwater project, please refer to the following NI 43-101 compliant technical reports and the Blackwater Preliminary Economic Assessment released on 21 October 2014, available at www.sedar.com under the Company’s name:

a) “NI 43-101 Technical Report, Macraes Gold Mine, Otago, New Zealand” dated October 14, 2020, prepared by D. Carr, Chief Metallurgist, of OceanaGold Management Pty Limited, T. Cooney, previously General Manager of Studies of OceanaGold Management Pty Limited, P. Doelman, Tech Services and Project Manager, S. Doyle, Principal Resource Geologist and P. Edwards, Senior Project Geologist, each of OceanaGold (New Zealand) Limited;

b) “Technical Report for the Reefton Project located in the Province of Westland, New Zealand” dated May 24, 2013, prepared by K. Madambi, previously Technical Services Manager of Oceana Gold (New Zealand) Limited and J. Moore, Chief Geologist, of Oceana Gold Management Pty Limited;

c) “Technical Report for the Didipio Gold / Copper Operation Luzon Island” dated March 31, 2022, prepared by D. Carr, Chief Metallurgist, P. Jones, Group Engineer and J. Moore, Chief Geologist, each of Oceana Gold Management Pty Limited;

d) Waihi District Study – Martha Underground Feasibility Study NI 43-101 Technical Report” dated March 31, 2021, prepared by T. Maton, Study Manager and P. Church, Principal Resource Development Geologist, both of Oceana Gold (New Zealand) Limited, and D. Carr, Chief Metallurgist, of OceanaGold Management Pty Limited; and

e) “NI 43-101 Technical Report Haile Gold Mine Lancaster County, South Carolina” dated March 31, 2022, prepared by D. Carr, Chief Metallurgist, G. Hollett, Group Mining Engineer, and J. Moore, Chief Geologist, each of OceanaGold Management Pty Limited, Michael Kirby of Haile Gold Mine, Inc., J. Poeck, M. Sullivan, D. Bird, B. S. Prosser and J. Tinucci of SRK Consulting, J. Newton Janney-Moore and W. Kingston of Newfields and L. Standridge of Call and Nicholas.

Cautionary Note Regarding Mineral Resources and Mineral Reserves

The Company’s disclosure of Mineral Reserve and Mineral Resource information is governed by NI 43-101 under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as may be amended from time to time by the CIM (“CIM Standards”). The disclosure of Mineral Reserve and Mineral Resource information for properties held by the Company is based on the reporting requirements of the JORC Code. CIM definitions of the terms “Mineral Reserve”, “Proven Mineral Reserve”, “Probable Mineral Reserve”, “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource”, are substantially similar to the JORC Code corresponding definitions of the terms “Ore Reserve”, “Proved Ore Reserve”, “Probable Ore Reserve”, “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource”, respectively. Estimates of Mineral Resources and Mineral Reserves prepared in accordance with the JORC Code would not be materially different if prepared in accordance with the CIM definitions applicable under NI 43-101.

There can be no assurance that those portions of such Mineral Resources that are not Mineral Reserves will ultimately be converted into Mineral Reserves. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. All Mineral Reserves are within the Mineral Resource.

Cautionary Statement for Public Release

Certain information contained in this public release may be deemed “forward-looking” within the meaning of applicable securities laws. Forward-looking statements and information relate to future performance and reflect the Company’s expectations regarding the generation of free cash flow, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of OceanaGold Corporation and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking statements and information. They include, among others, the accuracy of Mineral Reserve and resource estimates and related assumptions, inherent operating risks and those risk factors identified in the Company’s most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR at www.sedar.com under the Company’s name. There are no assurances the Company can fulfil forward-looking statements and information. Such forward-looking statements and information are only predictions based on current information available to management as of the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company’s control. Although the Company believes that any forward-looking statements and information contained in this press release is based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements and information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws. The information contained in this release is not investment or financial product advice.

NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()