“Following the severe polysilicon shortage in 2021, the ramp-up of new production capacities in China already left its mark on import volumes in 2022,” says Johannes Bernreuter, head of the polysilicon market specialist Bernreuter Research. Using preliminary production estimates, the market analyst puts China’s share in the global output of solar-grade polysilicon at 88% in 2022, up from 82% in 2021 and 55% in 2017.

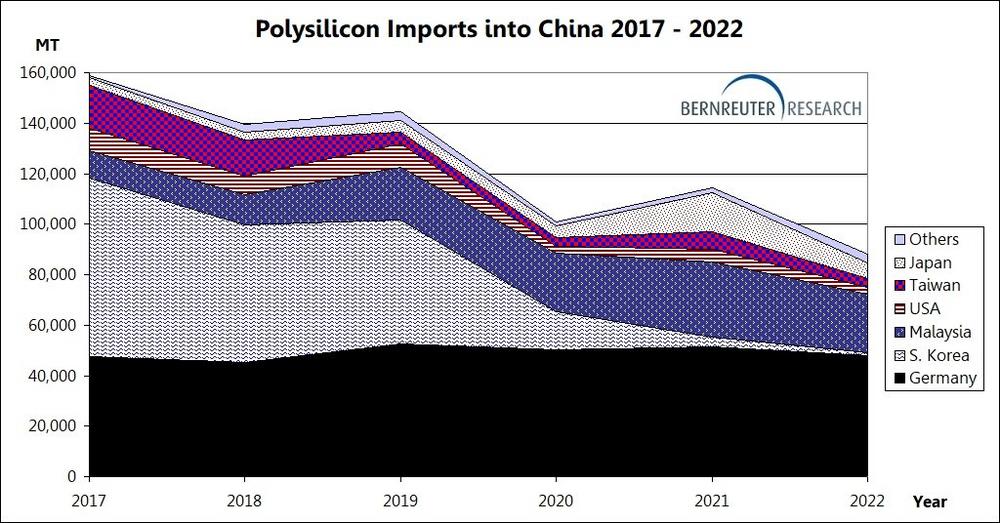

Compared to their peak of 158,918 MT in 2017, annual polysilicon imports into China have nearly halved. They are now close to the level of 2012 when they reached 82,760 MT.

The strongest decline in 2022 was seen in imports from Japan. In 2021 Japanese solar module producer Sharp obviously off-loaded large volumes of polysilicon inventory after the company’s long-term purchase contract with Hemlock Semiconductor expired in 2020. That drove up imports from Japan to a record high of 15,431 MT in 2021, thus filling the supply gap in China; in 2022, however, imports plummeted by 60% to 6,129 MT.

A similar development occurred in Taiwan, where former producers of solar wafers are still selling polysilicon stocks they own from long-term contracts into China. Imports from Taiwan dropped by 50% from 6,899 MT in 2021 to 3,480 MT.

The Malaysian polysilicon subsidiary of South Korean chemicals group OCI also exported significantly less to China – the volumes went down by 23% from 29,727 MT to 22,944 MT. This, however, was mainly due to longer-than-expected maintenance works at OCI’s factory in spring.

Imports from Germany’s Wacker, the largest foreign polysilicon supplier to China, decreased by 6.3% from 51,316 MT to 48,070 MT. U.S.-based Hemlock Semiconductor, which is impeded by high Chinese anti-dumping duties, reduced its volumes from 4,811 MT to 2,785 MT.

In the case of Wacker and Hemlock, the reason for the decline has to be searched for outside China. Both polysilicon manufacturers have concluded sales contracts with Jinko Solar, the world’s second largest module supplier; Jinko started up a new wafer factory with an annual production capacity of 7 GW in Vietnam in early 2022.

Trina Solar is the next major Chinese module producer that will open a wafer factory in Vietnam. “With the Uyghur Forced Labor Prevention Act that bans products from Xinjiang and the anti-circumvention decision against solar modules produced with Chinese wafers in Southeast Asia, the United States are driving the demand for solar panels made of polysilicon and wafers not coming from China,” explains Bernreuter. “At the same time, polysilicon imports into China will shrink further in view of the massive domestic capacity expansion. Consequently, the future of non-Chinese polysilicon feedstock lies outside China.”

Bernreuter Research was founded in 2008 by Johannes Bernreuter, one of the most reputable PV journalists in Germany, to publish polysilicon market reports. As early as 2001, he wrote his first analysis of the upcoming polysilicon bottleneck and new production processes. In 2010 Bernreuter Research issued The Who’s Who of Solar Silicon Production, which industry experts have praised as the most comprehensive and accurate polysilicon report on the market.

Bernreuter Research

Lessingstr. 6

97072 Würzburg

Telefon: +49 (931) 784 77 81

Telefax: +49 (931) 784 77 82

https://www.bernreuter.com

Inhaber

Telefon: +49 (931) 78477-81

E-Mail: info@bernreuter.com

![]()