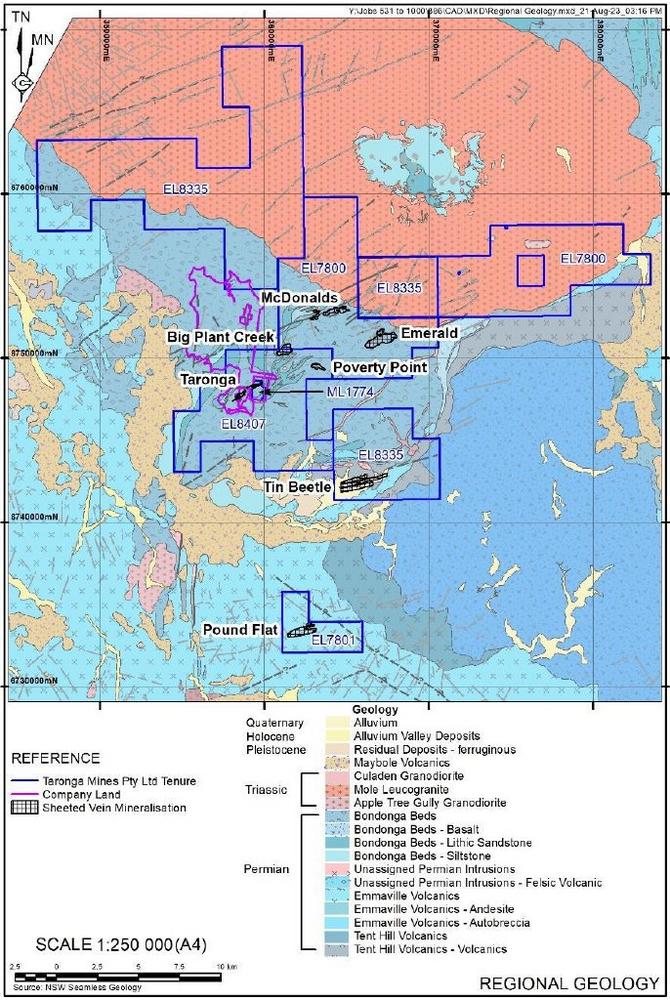

Tin Beetle is one of six additional prospects near Taronga that have potential for satellite or stand-alone tin mineralisation (Figure 1).

Highlights

- Initial assay results from very wide spaced drilling confirm wide intervals of tin mineralisation with narrower zones of higher grade mineralisation

- Significant intercepts include:

- 48m @ 0.18% Sn from 2m incl. 21m @ 0.32% Sn from 2m and 3m @ 0.28% Sn from 42m

- 30m @ 0.10% Sn from surface incl. 7m @ 0.16% Sn from 21m (entire hole mineralised)

- 18m @ 0.07% Sn from 17m incl. 9m @ 0.10% Sn from 17m

- 78m @ 0.08% Sn from 7m incl. 12m @ 0.11% Sn from 7m and 12m @ 0.13% Sn from 48m

- 57m @ 0.05% Sn from 62m

- 27m @ 0.08% Sn from 76m incl. 14m @ 0.12% Sn from 77m and 5m @ 0.18% Sn from 85m

- These intercepts are similar to early drill intercepts at the main Taronga mineralisation

- Tin Beetle appears to have lower copper and silver content, but higher zinc content than Taronga

- The Tin Beetle prospect is located approximately 9km southeast of the main Taronga mineralisation, providing potential for it to be taken by road to a central milling facility at Taronga following on-site upgrading by crushing and possible jigging

- If successful, this concept could significantly add to the annual tin production and/or increase the overall mine life of the Taronga tin project

First Tin CEO Thomas Buenger said: “We are pleased to announce that this drilling has proven our thesis that Taronga is part of a tin district rather than a singular tin occurrence. The recent drill intercepts at Tin Beetle are similar to early drill intercepts at the main Taronga project.

Tin Beetle, like Taronga, also appears to benefit from extremely favourable, sheeted vein style, cassiterite mineralisation, with simple mineral processing characteristics, that outcrops at surface, and could therefore potentially be mined as an open pit. The confirmation of mineralisation over the entire 2.3km drilled to date suggests potential for several open pits in the area. This could significantly improve annual tin output and/or mine life for the Taonga tin project as a whole.

Follow-up drilling is planned for next year following completion of the Taronga DFS.”

The project is owned by First Tin’s 100% owned Australian subsidiary, Taronga Mines Pty Ltd (“TMPL”).

All assay results are presented in Table 1. The true width of intervals is around half the downhole width. Estimated true widths are included in Table 1.

The drilling targeted a broad area (3km x 0.6km) of mineralisation that had been mined for alluvial and eluvial tin during the 19th and 20th Centuries. It is defined by large workings that have stripped the alluvial material and then continued into weathered, clayey felsic volcanics with sheeted greisen veins hosting cassiterite (tin oxide) mineralisation. This was historically referred to as “soft rock” mineralisation. Four ENE trending zones of sheeted veining are interpreted from the outlines of workings, tin geochemistry, mapped areas of veining and limited previous drilling (Figure 2).

The current TMPL drilling has confirmed and extended at depth, mineralisation identified by previous explorers in the late 1970s and early 1980s. The mineralisation intersected is variable in thickness and grade and it is interpreted that several moderately sized higher-grade deposits exist within the overall very large, low-grade mineralisation system.

One area with good outcropping tin mineralisation has been tested by four drillholes (TMGBRC001-4) over about 250m of strike in the central part of the central zone (Figure 2). This has confirmed mineralisation with similar grade to the main Taronga mineralisation (0.10 to 0.18% Sn) over the entire 250m and with true widths of between 5m and 25m. This could potentially be mined using open pit techniques as mineralisation outcrops at surface.

Three other areas have been tested by a single line of drillholes each, and all of these have returned broad widths of low-grade mineralisation containing smaller, higher-grade zones, suggesting potential for several open pits in the district. Drillhole TMGBRC006 returned a very broad mineralised zone of 78m grading 0.08% Sn, with two higher grade zones of 12m @ 0.11% Sn and 12m @ 0.13% Sn. This is beneath the main area of “soft rock” mineralisation mined by dredges during the 1970s and 1980s (see dredge pits on Figure 2) and provides a very large target in this area.

TMPL considers the Tin Beetle prospect to be one of several potential satellite deposits for Taronga, with treatment via preconcentration using simple crushing and possibly jigging and then trucking the concentrate approximately 8-9km to Taronga for final processing (Figure 1). If successful, this concept could either add to annual tin production, increase the overall mine life after Taronga mineralisation has been exhausted, or both.

It is proposed that a systematic drilling programme be undertaken over the prospect area, following completion of the Taronga DFS, designed to outline higher grade, potentially mineable zones within this large mineralisation system.

Further Information is attached.

Notes to Editors

First Tin is an ethical, reliable, and sustainable tin production company led by a team of renowned tin specialists. The Company is focused on becoming a tin supplier in conflict-free, low political risk jurisdictions through the rapid development of high value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and electrify the world, yet Europe has very little supply. Rising demand, together with shortages, is expected to lead tin to experience sustained deficit markets for the foreseeable future. Its assets have been de-risked significantly, with extensive work undertaken to date.

First Tin’s goal is to use best-in-class environmental standards to bring two tin mines into production in three years, providing provenance of supply to support the current global clean energy and technological revolutions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()