“Comprehensive reviews completed by the Project team and third-party consultants have greatly improved visibility towards initial production at Terronera later this year”, said Dan Dickson, Endeavour’s CEO. “Given the trends that we have seen at our existing Mexican operations, Terronera is being advanced against headwinds, which include a stronger Mexican Peso, ongoing inflation and tight markets for equipment and bulk materials such as steel, piping and electrical supplies. After undergoing an in-depth process, we remain confident in our commissioning schedule, our updated capital cost estimate, and our ability to address these challenges as we advance the project for the benefit of all stakeholders.”

Updated Initial Capital Cost

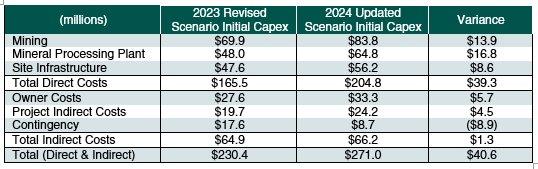

As previously announced, the Board approved an optimized Terronera Project construction scenario (the “Revised Scenario”), consisting of a process plant with 2,000 tonne per day (“tpd”) capacity and an initial capital cost of $230 million (see news release dated April 18, 2023). While the Company successfully locked in pricing for much of the mine and plant equipment with early purchases, market trends persist with ongoing inflation, foreign exchange pressures related to a stronger Mexican Peso, and tight supply for equipment and bulk material. To ensure the cost pressures have been properly quantified, the Project team conducted a comprehensive review of the remaining cost to complete Terronera. Endeavour now forecasts initial capital costs to be 18% higher, at $271 million (the “2024 Updated Scenario”).

Below summarizes the main items impacting the 2024 Updated Scenario initial capital cost forecast:

- Mill equipment purchases contributed an additional $11 million, primarily for E-houses and transformers, which have been ordered with final deliveries expected in Q2 2024. The higher electrical equipment costs reflect escalating component prices and increases due to supply availability.

- Structural steel fabrication contributed an additional $8 million; steel prices have increased due to significant demand within the region. Also, additional tonnage is required for design changes made during detail engineering. The Company has delivery commitments from several fabrication shops, which began in early January, and are being planned according to the construction schedule requirements through Q2 2024.

- Tailing storage facility (“TSF”) design changes contributed an additional $5.5 million; following final geotechnical site investigation studies, modifications were required for local conditions and to meet seismic load requirements. The strength of the Mexican Peso has also impacted the cost forecast.

- The Company forecasts an additional $13.9 million on mine development, equipment, and infrastructure expenditures through commissioning. Much of the additional cost is for mobile equipment at both the Terronera and La Luz mines. Tradeoff evaluations show considerable savings through self-performed development and production, compared to escalating contractor mining prices. Additional mining equipment will be purchased earlier than originally planned to ensure sustained production during ramp up. Additional costs are anticipated from the strengthened Mexican Peso for labor and direct inputs sourced in-country.

- The permanent camp was completed for $2.2 million more than budget. A combination of additional scope, the impact of the strengthened Mexican Peso and inflationary costs impacted the final cost.

- Management has allocated $8.9 million from the $17.6 million contingency for additional cost forecasts for detail engineering, mine waste rock dump construction and indirect owner and construction management expenditures.

The Company’s early move to assemble an experienced Project team has provided the expertise to mitigate some of these impacts. Management believes the Company is well-equipped to meet the challenges of the current business environment. The Company has worked with external advisors and independent engineers to ensure forecasts are appropriately supported and verified. Management assumed a 17.5 Mexican Peso per US dollar exchange rate for 2024, which impacts on-going labor costs primarily incurred in mine development and project indirect costs. The Company plans to provide operational guidance as construction approaches commissioning.

Development and Execution Plan

In 2023, project activity focused on completing bulk earthworks, major mobile mining equipment procurement, detail engineering, access road construction, advancing plant concrete, constructing the permanent camp, and development advance in Portals 1, 2 and 4. At the end of the year, construction progress was approaching 50% completion.

In 2024, the Q1 surface construction will focus on structural steel erection, mechanical installations and initial electrical work for the crushing, coarse-ore stockpile, grinding, flotation and tailing thickener areas. Excavation is expected to be nearing completion for the LNG and power generation areas and the concentrate and tailing filtration areas at the end of Q1. In Q2 and Q3, work is planned to advance in all plant areas with mechanical completion and commissioning activities planned in Q4 with initial production at the end of 2024.

For the mine, development of Portals 1, 2 and 4 will continue with first ore development anticipated in Q2. The first long-hole mining is planned for Q3 and cut-and-fill mining is planned to begin in Q4 with accumulation of the stockpile during this period. Development activities at La Luz are expected to begin in Q3 with portal construction and ramp advance to ore access in Q4.

The project remains on schedule for mill commissioning and initial production in the fourth quarter of 2024. The critical path remains the underground mine development where advance rates have been steadily increasing and the TSF construction.

Project Funding

The Company is well-positioned to satisfy the financing requirements of the project. The Company expects to make the first draw under the $120 million project loan debt facility in the first quarter of 2024. Construction of the project remains on track and the funds available under the project loan debt facility will be allocated to fund construction. Management will provide updated expenditures through to December 31, 2023, as part of year-end financial reporting.

Launch of Project Website

The Company is pleased to introduce a dedicated project website, accessible at www.terronera.com. This new website will serve as a virtual hub for the local community, key stakeholders, and other interested parties to stay informed and engaged with the ongoing progress of the Terronera Project. The Company invites all stakeholders to explore the latest updates, learn about our commitment to environmental stewardship and discover the positive impacts this venture will bring to local communities.

About the Terronera Project

The Terronera project is a high-grade silver-gold project being developed in the San Sebastian mining district in Jalisco state, Mexico. It is located within the Sierra Madre volcanic belt, which hosts most of Mexico’s gold and silver deposits. It is a low-sulphidation epithermal vein system that will be mined using a combination of long hole and cut and fill techniques. The underground mine consists of two deposits, Terronera and La Luz, which will feed a centralized 2,000 tonne per day process plant. Based on the Feasibility Study, Terronera is expected to produce 4 million ounces of silver and 38,000 ounces of gold annually over its 10-year life.

For more information about the project and details of the Feasibility Study, the technical report is entitled “NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico” dated October 21, 2021 with an effective date of September 9, 2021, and it is available on the company website or under the Company’s name on SEDAR at www.sedar.com.

Technical Disclosure

The scientific and technical information contained in this news release has been reviewed and approved by Don Gray, SME-RM., Chief Operating Officer, a Qualified Person as defined under NI 43-101.

About Endeavour Silver – Endeavour is a mid-tier precious metals mining company that operates two high-grade underground silver-gold mines in Mexico. Endeavour is advancing construction of the Terronera Project and exploring its portfolio of exploration projects in Mexico, Chile and the United States to facilitate its goal to become a premier senior silver producer. Our philosophy of corporate social integrity creates value for all stakeholders.

Contact Information

Galina Meleger, VP, Investor Relations

Email: gmeleger@edrsilver.com

Website: www.edrsilver.com

Follow Endeavour Silver on Facebook, X, Instagram and LinkedIn.

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the United States private securities litigation reform act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Such forward-looking statements and information herein include but are not limited to statements regarding the development and financing of the Terronera Project including: capital cost estimates, anticipated timing of the project construction; anticipated timing of drawdown under the project loan debt facility, Terronera’s forecasted operations, costs and expenditures, and the timing and results of various related activities. The Company does not intend to and does not assume any obligation to update such forward-looking statements or information, other than as required by applicable law.

Forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, production levels, performance or achievements of Endeavour and its operations to be materially different from those expressed or implied by such statements. Such factors include but are not limited changes in production and costs guidance; the ongoing effects of inflation and supply chain issues on mine economics; national and local governments, legislation, taxation, controls, regulations and political or economic developments in Canada and Mexico; financial risks due to precious metals prices; operating or technical difficulties in mineral exploration, development and mining activities; risks and hazards of mineral exploration, development and mining; the speculative nature of mineral exploration and development; risks in obtaining necessary licenses and permits; satisfaction of conditions precedent to drawdown under the project loan debt facility; the ongoing effects of inflation and supply chain issues on the Terronera Project economics; fluctuations in the prices of silver and gold, fluctuations in the currency markets (particularly the Mexican peso, Chilean peso, Canadian dollar and U.S. dollar); and challenges to the Company’s title to properties; as well as those factors described in the section “risk factors” contained in the Company’s most recent form 40F/Annual Information Form filed with the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to: the continued operation of the Company’s mining operations, no material adverse change in the market price of commodities, forecasted Terronera mine economics as of 2024, mining operations will operate and the mining products will be completed in accordance with management’s expectations and achieve their stated production outcomes, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any forward-looking statements or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()