Tony M, along with our Daneros and Rim projects, is one of three past-producing, fully-permitted, uranium mines in Utah owned by IsoEnergy, and is a large-scale, fully-developed and permitted underground mine that previously produced nearly one million pounds of U3O8 during two different periods of operation, from 1979-1984 and from 2007-2008.

Highlights

- Reopening of the Underground and Comprehensive Work Program – The Company plans to reopen the main decline into the Tony M mine and gain underground access by the end of H1-2024. This critical step is expected to facilitate the assessment of the mine’s underground conditions, enable direct analysis of the uranium mineralization in place, and allow for the collection of necessary data required to prepare an efficient mine plan. The work program also includes underground and surface geological mapping of the sandstone-hosted uranium and vanadium mineralization to allow for more precise extraction plans for inclusion in an updated economic study.

- Technical/Economic Study Planned (the “Study”) – The Company intends to complete a Study, which will provide further details on a potential restart date and a mine plan that will provide production plans and rates, expected operational costs and capital requirements.

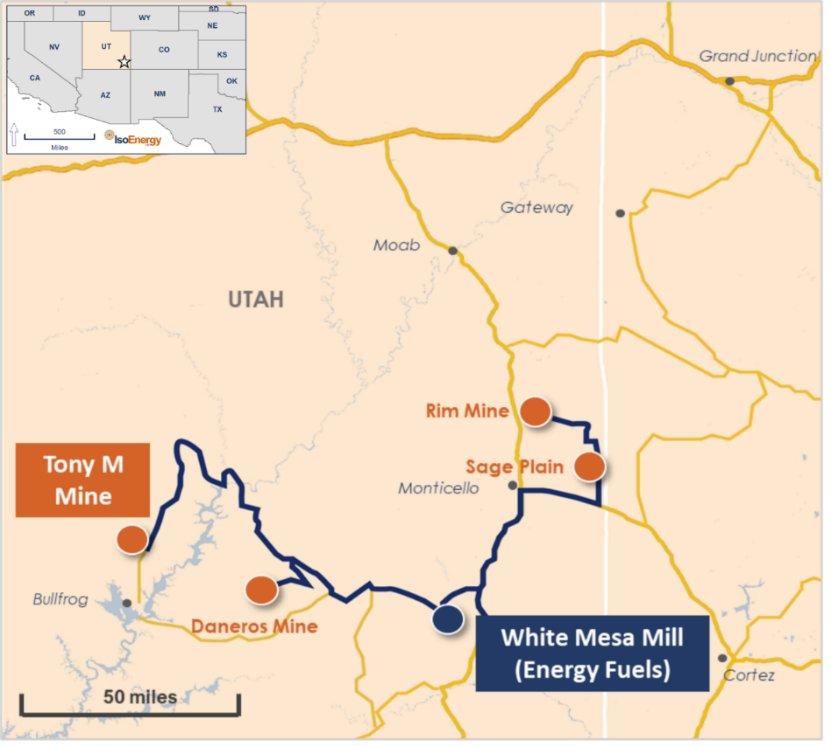

- Toll-Milling Arrangement with EFR – IsoEnergy has a toll milling arrangement with EFR for its Tony M, Daneros, Rim and Calliham projects, which guarantees the Company access to the White Mesa Mill, the only operational conventional uranium mill in the U.S. On December 21, 2023, EFR announced its plans to restart the White Mesa Mill uranium circuit in 2025. As a result, and to support additional feed, IsoEnergy intends to deliver ore to the Mill in time for the restart of the uranium circuit.

- Commencement into Multi-Asset Production – The reopening of the Tony M mine is a first step in IsoEnergy’s plan to becoming a multi-asset uranium producer. IsoEnergy is also evaluating plans to restart operations at the Daneros and Rim mines, both of which were previous producers of uranium and vanadium, and are currently permitted for production.

- Staffing up for Re-Opening – The Company has appointed Josh Clelland to the position of Director of US Engineering and Operations, to manage the reopening of the Tony M Mine, and advancement of the Company’s other US-based uranium projects. Josh is a Professional Mining Engineer with over 20 years of experience in the mining industry, including significant experience operating in both underground and open pit environments. He joins us from a major global gold producer where in his most recent role he was a Superintendent of Mine Operations. Josh’s additional experience includes a Corporate Development role at a major producer, technical advisory at a major international mining consulting firm, and research at a Canadian brokerage firm, during which time Josh earned his Chartered Financial Analyst designation.

IsoEnergy CEO and Director Phil Williams stated, “With the uranium spot price now trading around US$100 per pound[1], we are in the very fortunate position of owning multiple, past-producing, fully-permitted uranium mines in the U.S. that we believe can be restarted quickly with relatively low capital costs. Our existing toll-milling agreement with Energy Fuels places IsoEnergy in a unique position to become a conventional uranium producer in the near-term.

Multiple work streams are now underway to move our flagship Tony M Mine back toward production in 2025, in line with the timing Energy Fuels has announced for its White Mesa Mill for which IsoEnergy has a toll milling agreement. Given current and expected near term uranium market dynamics, we think this restart timing is ideal and would firmly place us in a very small group of uranium companies able to deliver uranium production in the near term. I would also like to welcome Josh to the team. We are fortunate to be able to attract such high-quality talent, which we believe is a testament to our projects and vision for the Company.”

Tony M Mine Work Program

The Company is continuing to advance plans to reopen the underground mine workings in preparation for a potential restart of Tony M. This work program includes updating mine ventilation and escape plans, maintenance of the existing ventilation fans and power infrastructure, surveying of the underground mine workings, rehabilitation of mine workings and ground support as needed, and upgrading and/or replacement of utilities.

Rehabilitation of the underground is expected to take place during H1-2024, followed by planned geologic mapping and sampling alongside mine planning ahead of anticipated completion of the Study. The Company currently expects to utilize contract mining initially. In addition to the 18 miles of underground development, including multiple production headings, the Mine has complete surface infrastructure in place (Figure 2).

IsoEnergy continues to work with RME Consulting, a leading international, technical underground mining ventilation and refrigeration design firm, to oversee the design and implementation of the ventilation plan and Call & Nicholas, Inc., an international mining consulting firm that specializes in geological engineering, geotechnical engineering, and hydrogeology, to assess the mine’s ground conditions.

IsoEnergy has guaranteed access to the White Mesa Mill by way of a toll milling agreement with Energy Fuels, providing a significant advantage to the Company. The Mill is the only operational conventional uranium mill in the U.S. with licensed capacity of over 8Mlbs of U₃O₈ per year. The Mill is within trucking distance to Tony M. It is an important distinction worth noting that a toll milling agreement and the selling of ore to EFR/White Mesa are very different, with toll milling allowing IsoEnergy to participate in the upside of the uranium price.

About Tony M Mine

The Tony M Mine is located in eastern Garfield County, southeastern Utah, approximately 66 air miles (107 kilometers) west northwest of the town of Blanding and 215 miles (347 kilometers) south-southeast of Salt Lake City. The project is the site of the Tony M underground uranium mine that was developed by Plateau Resources, a subsidiary of Consumer Power Company, in the mid-1970s.

Uranium and vanadium mineralization at the Tony M mine is hosted in sandstone units of the Salt Wash Member of the Jurassic age Morrison Formation, one of the principal hosts for uranium deposits in the Colorado Plateau region of Utah and Colorado.

Tony M has been estimated to contain the following mineral resources:

Table 1: Summary of Mineral Resources – Effective Date September 9, 2022

Notes:

- Reported in the Technical Report on the Tony M Project, Utah, USA Report for NI 43-101, prepared for Consolidated Uranium Inc. by SLR International Corporation; Mark B. Mathisen, Qualified Person, Effective Date September 9, 2022.

- CIM (2014) definitions were followed for all Mineral Resource categories.

- Uranium Mineral Resources are estimated at a cut-off grade of 0.14% U3O8.

- The cut-off grade is calculated using a metal price of $65/lb U3O8.

- No minimum mining width was used in determining Mineral Resources.

- Mineral Resources are based on a tonnage factor of 15 ft3/ton (Bulk density 0.0667 ton/ft3 or 2.14 t/m3).

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Past production (1979-2008) has been removed from the Mineral Resource.

- Totals may not add due to rounding.

- Mineral Resources are 100% attributable to IsoEnergy and are in situ.

Qualified Person Statement

The scientific and technical information contained in this news release was reviewed and approved by Dean T. Wilton: PG, CPG, MAIG, a consultant of IsoEnergy who is a “Qualified Person” (as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects).

About IsoEnergy Ltd.

IsoEnergy Ltd. (TSXV: ISO) (OTCQX: ISENF) is a leading, globally diversified uranium company with substantial current and historical mineral resources in top uranium mining jurisdictions of Canada, the U.S., Australia, and Argentina at varying stages of development, providing near, medium, and long-term leverage to rising uranium prices. IsoEnergy is currently advancing its Larocque East Project in Canada’s Athabasca Basin, which is home to the Hurricane deposit, boasting the world’s highest grade Indicated uranium Mineral Resource.

IsoEnergy also holds a portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah with a toll milling arrangement in place with Energy Fuels Inc. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer.

For More Information, Please Contact:

Phill Williams

CEO and Director

info@isoenergy.ca

1-833-572-2333

X: @IsoEnergyLtd

www.isoenergy.ca

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

The information contained herein contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including, without limitation, statements with respect to the planned work program starting in H1-2024 and potential results and benefits thereof; plans for the potential restart of mining operations at Tony M, Daneros and Rim; expectations regarding the preparation and timing of the Study; underground sampling program and potential benefits thereof; expectations regarding the preparation of a potential vanadium mineral resource estimate; expectations regarding the potential upgrade of existing mineral resources from “inferred” to “indicated”; expectations regarding the restart of Tony M; expectations regarding the preparation and timing of a Preliminary Economic Assessment; the Company’s ongoing business plan, sampling, exploration and work programs. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the price of uranium, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves, the limited operating history of the Company, the influence of a large shareholder, alternative sources of energy and uranium prices, aboriginal title and consultation issues, reliance on key management and other personnel, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, availability of third party contractors, availability of equipment and supplies, failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to the Company set out in the Company’s filings with the Canadian securities regulators and available under IsoEnergy’s profile on SEDAR+ at www.sedarplus.ca.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()